Ive analyzed theZillow Home Value Indexdata to identify the fastest-growing towns in Kentucky from 2016 to 2025.

They reflect the broader shift in where and how people want to liveand invest.

This report ranks the towns by percentage growth and outlines the financial upside of each.

Home Stratosphere | Leaflet

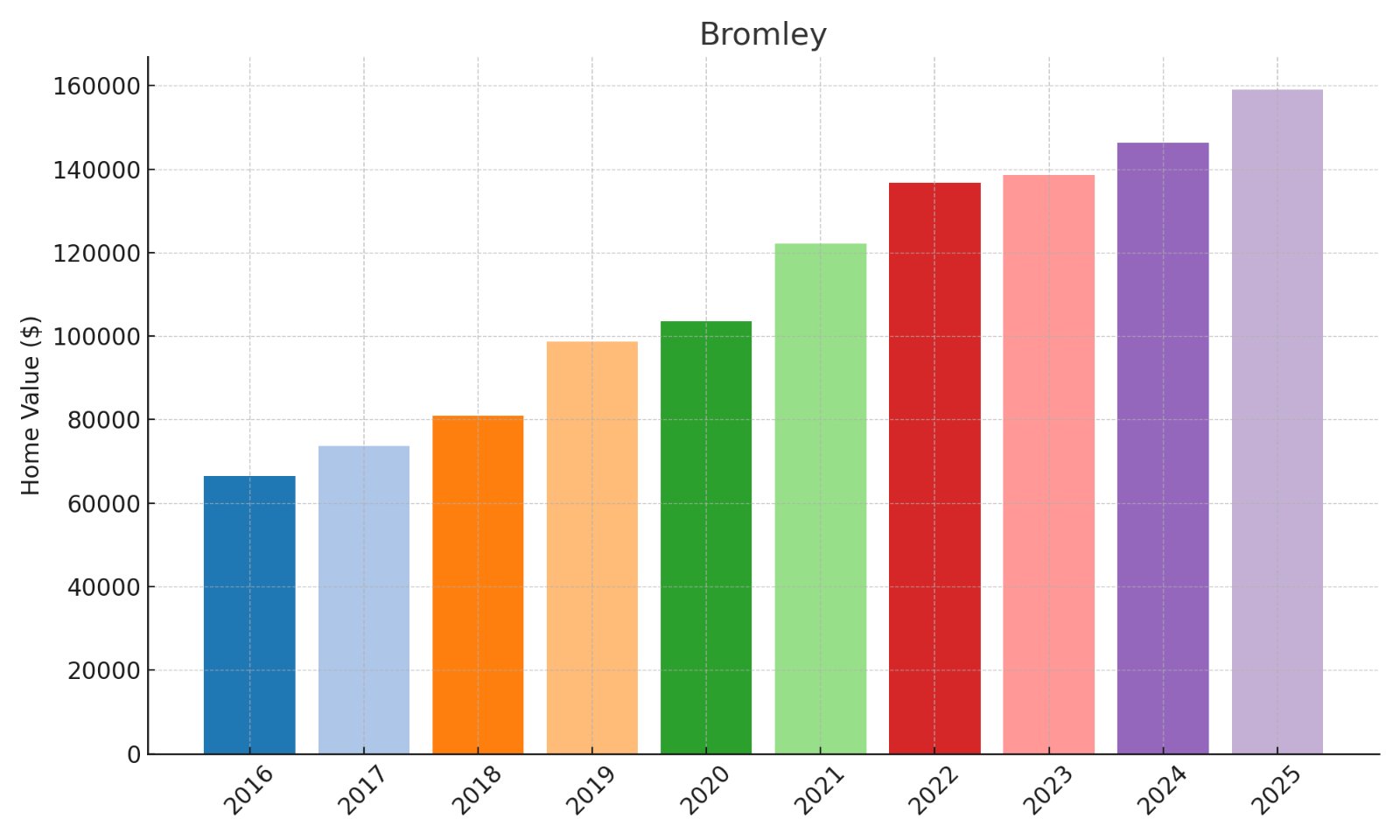

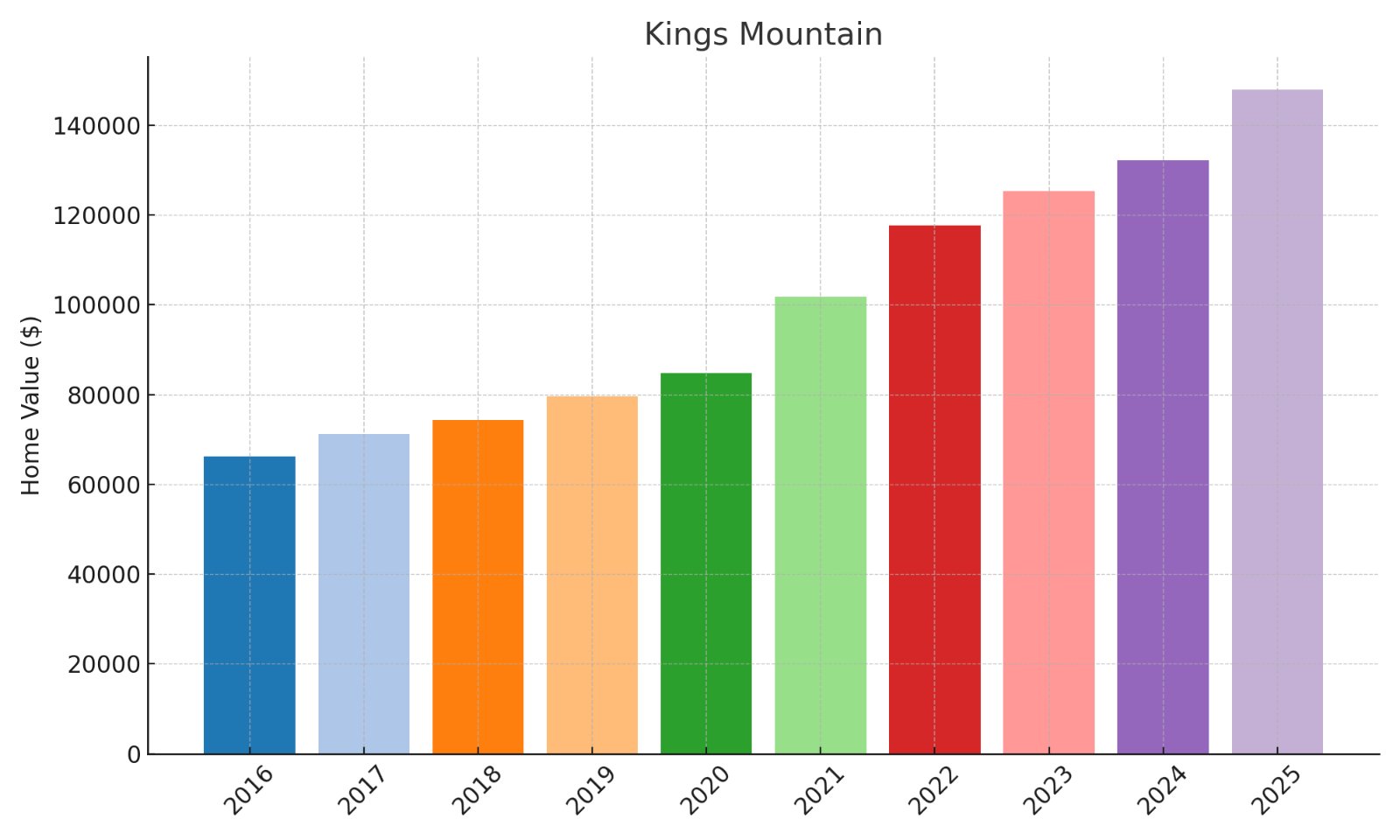

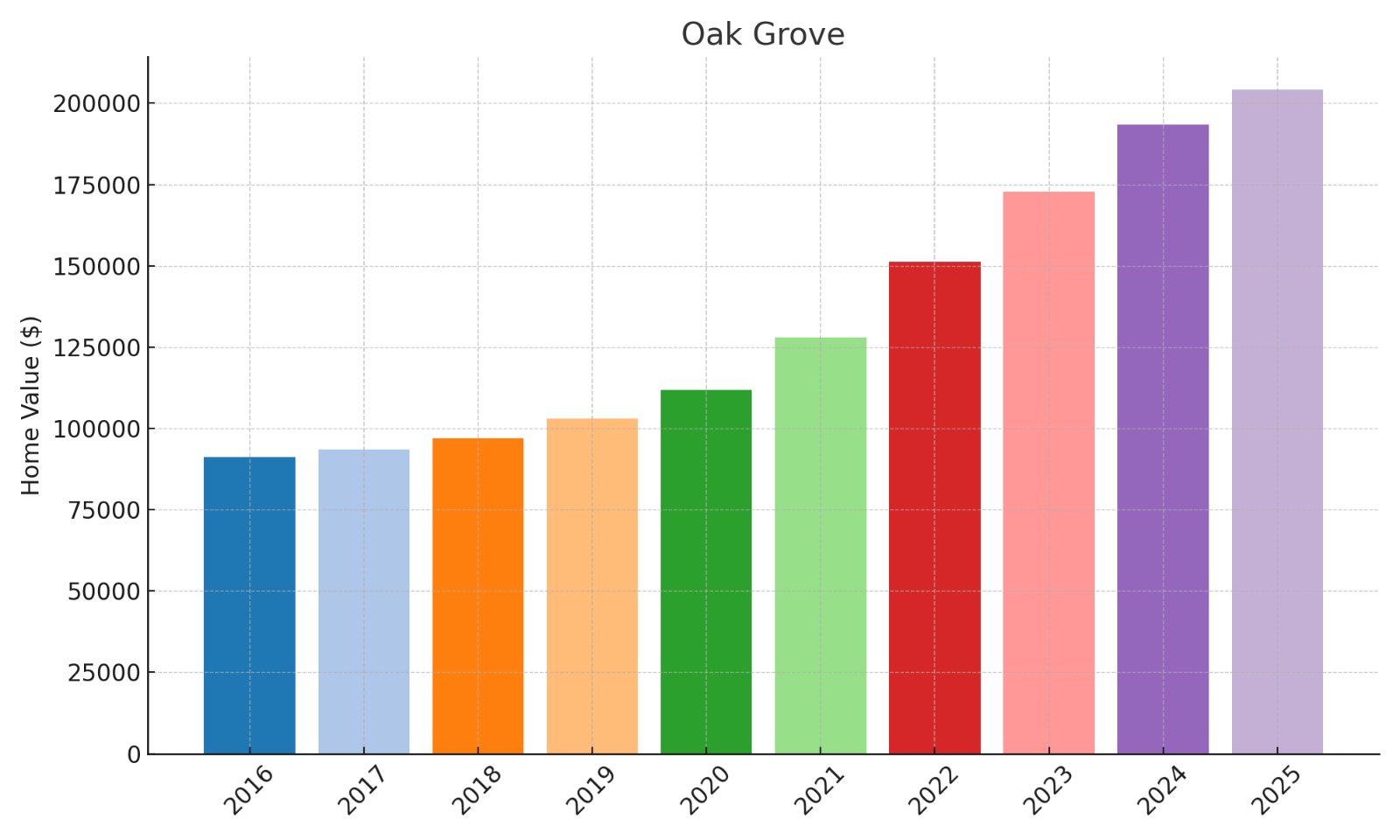

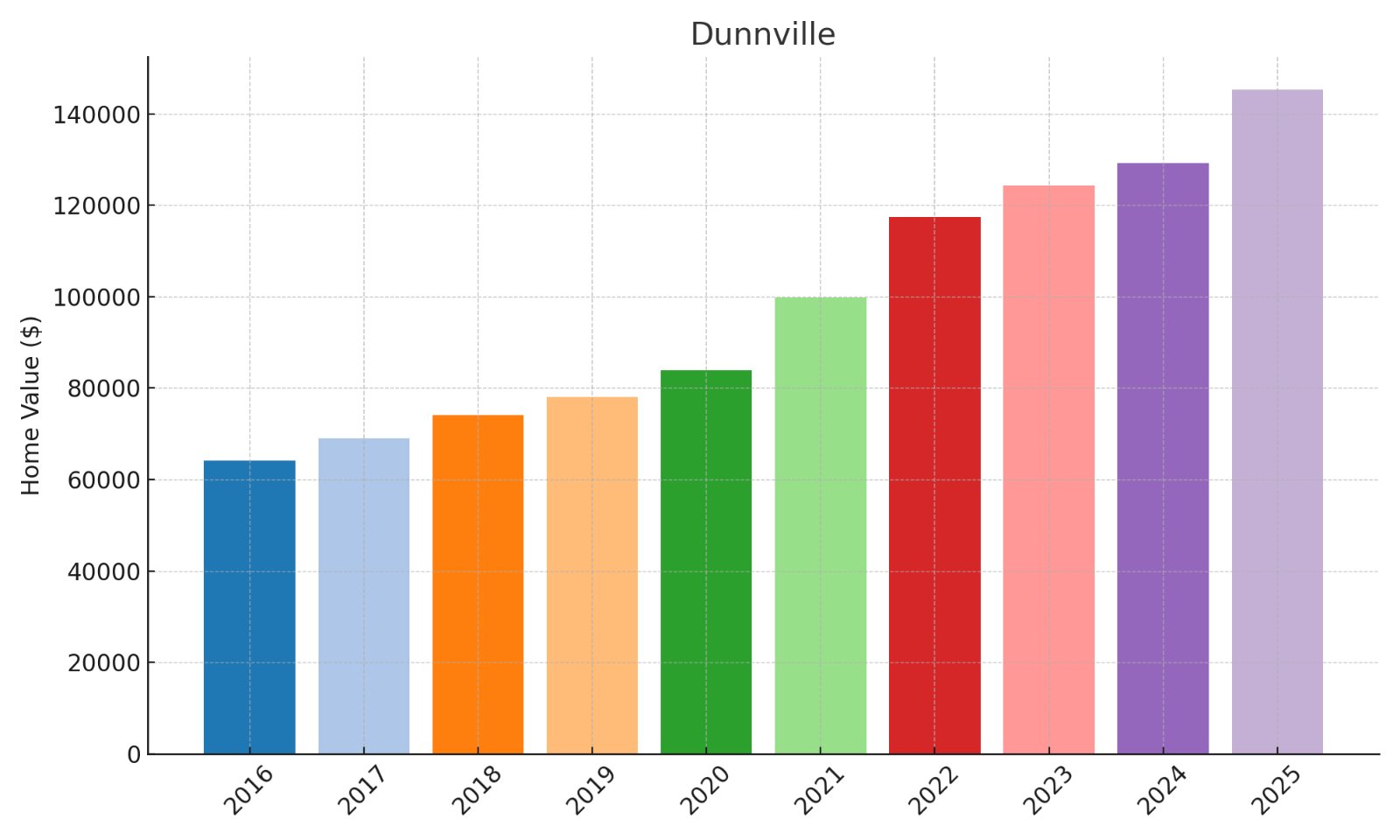

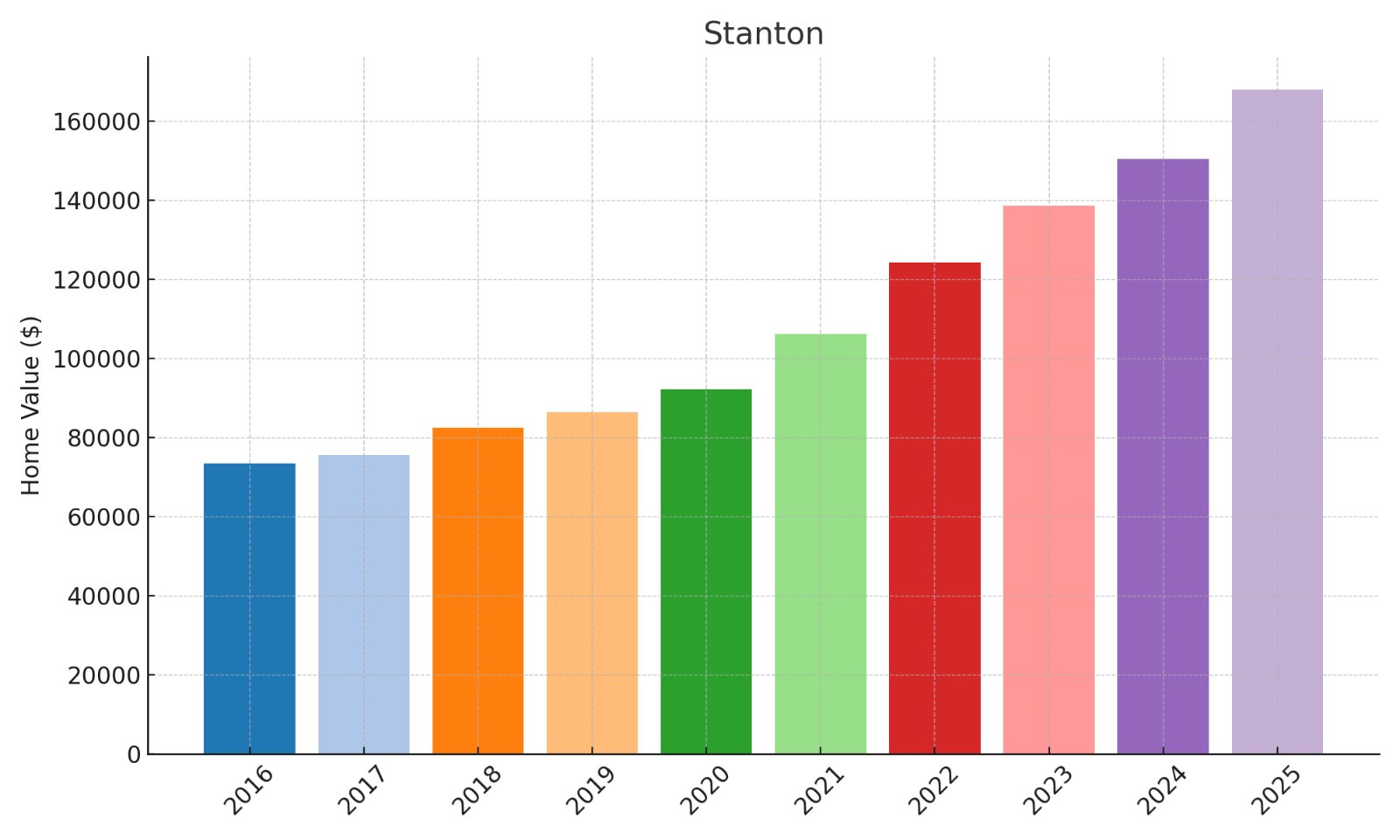

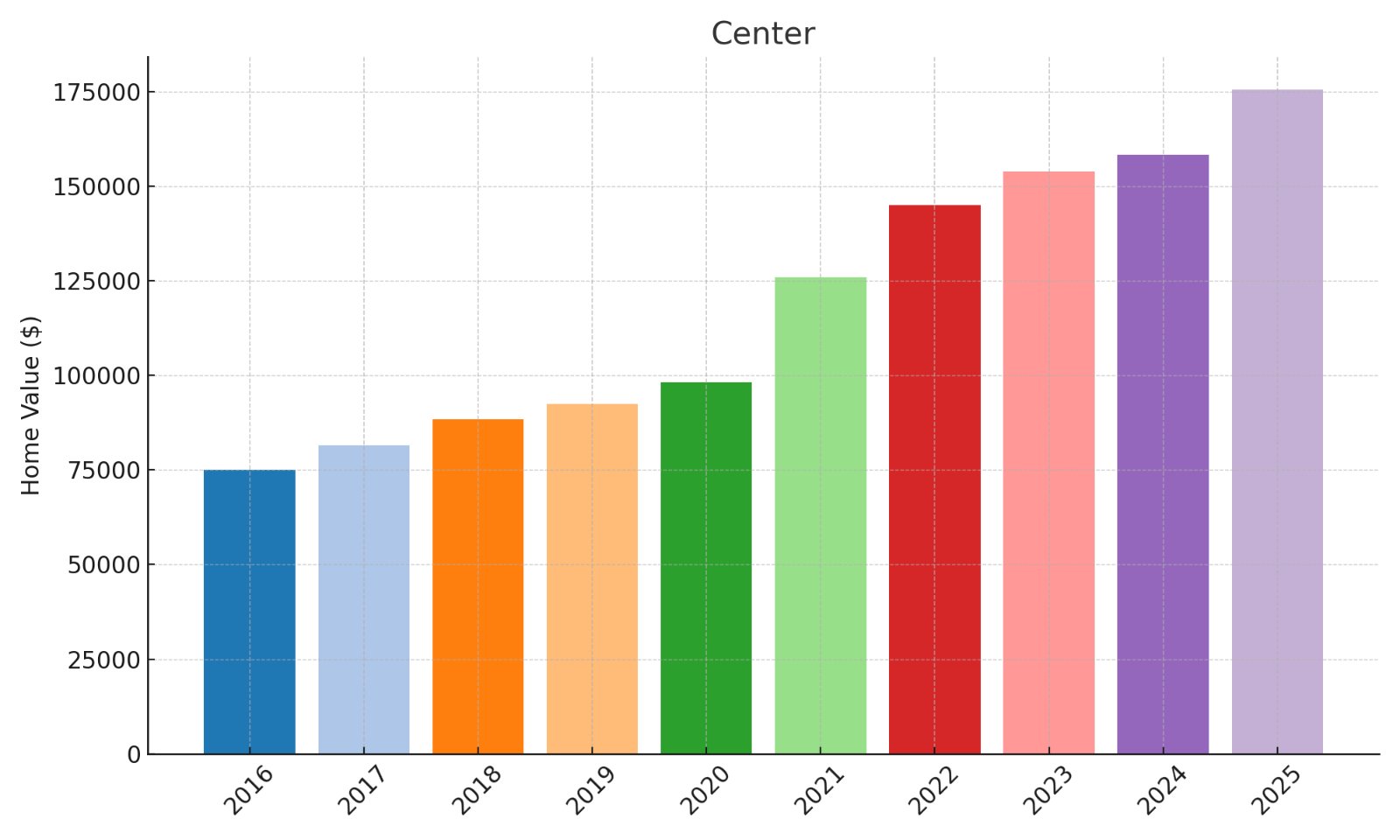

The acceleration beginning in 2020-2021 suggests fundamental market repositioning rather than speculative activity.

Current price points remain significantly below replacement costs, suggesting continued appreciation runway before reaching construction parity.

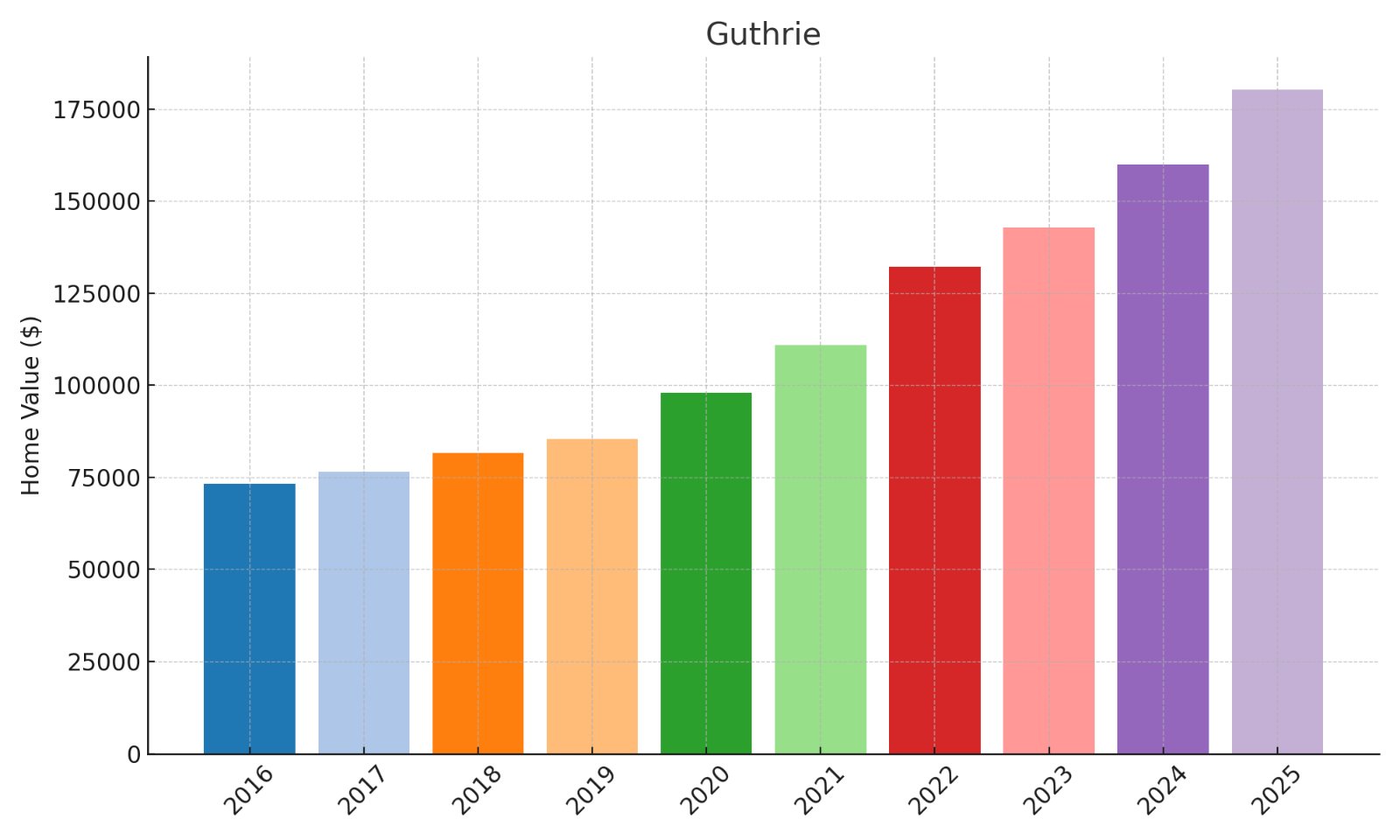

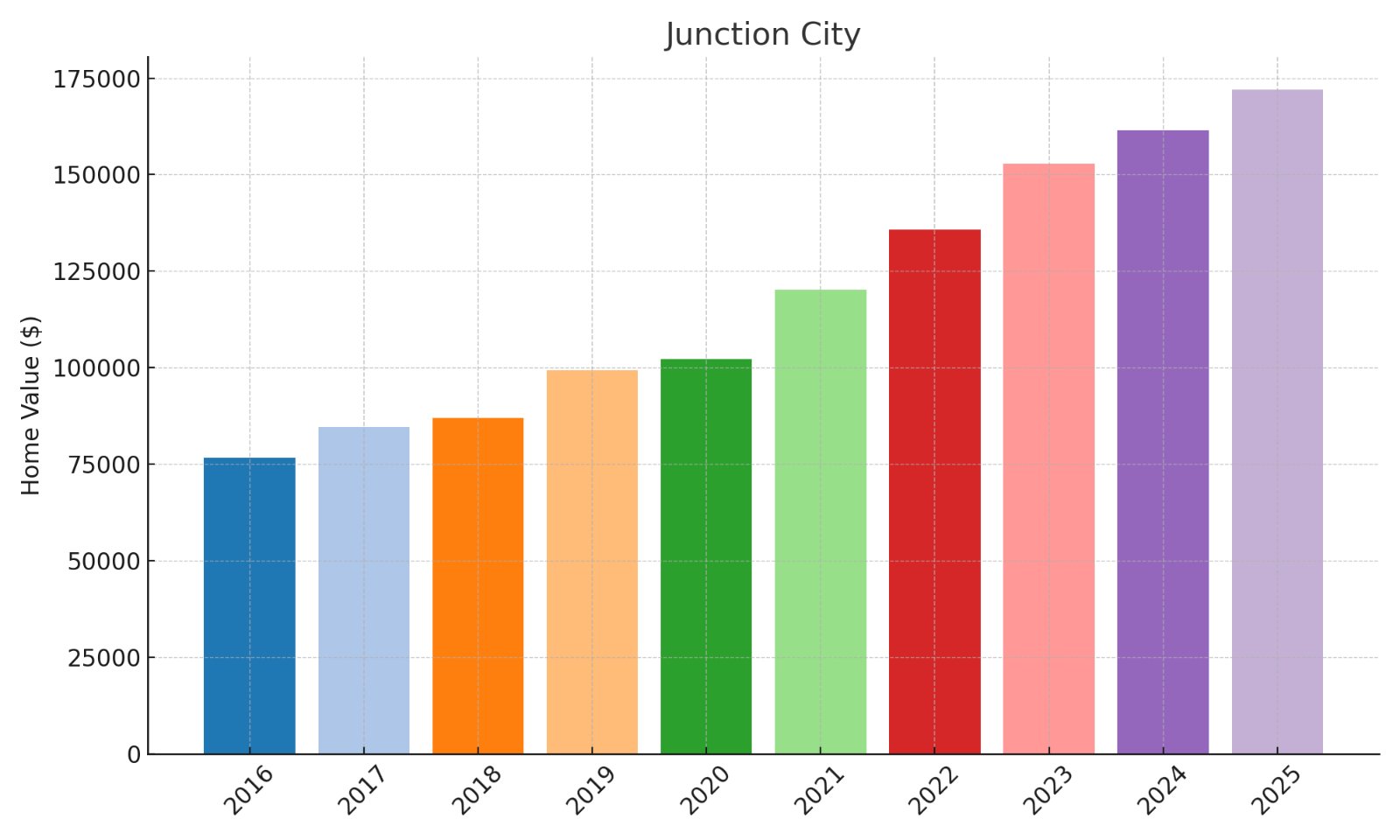

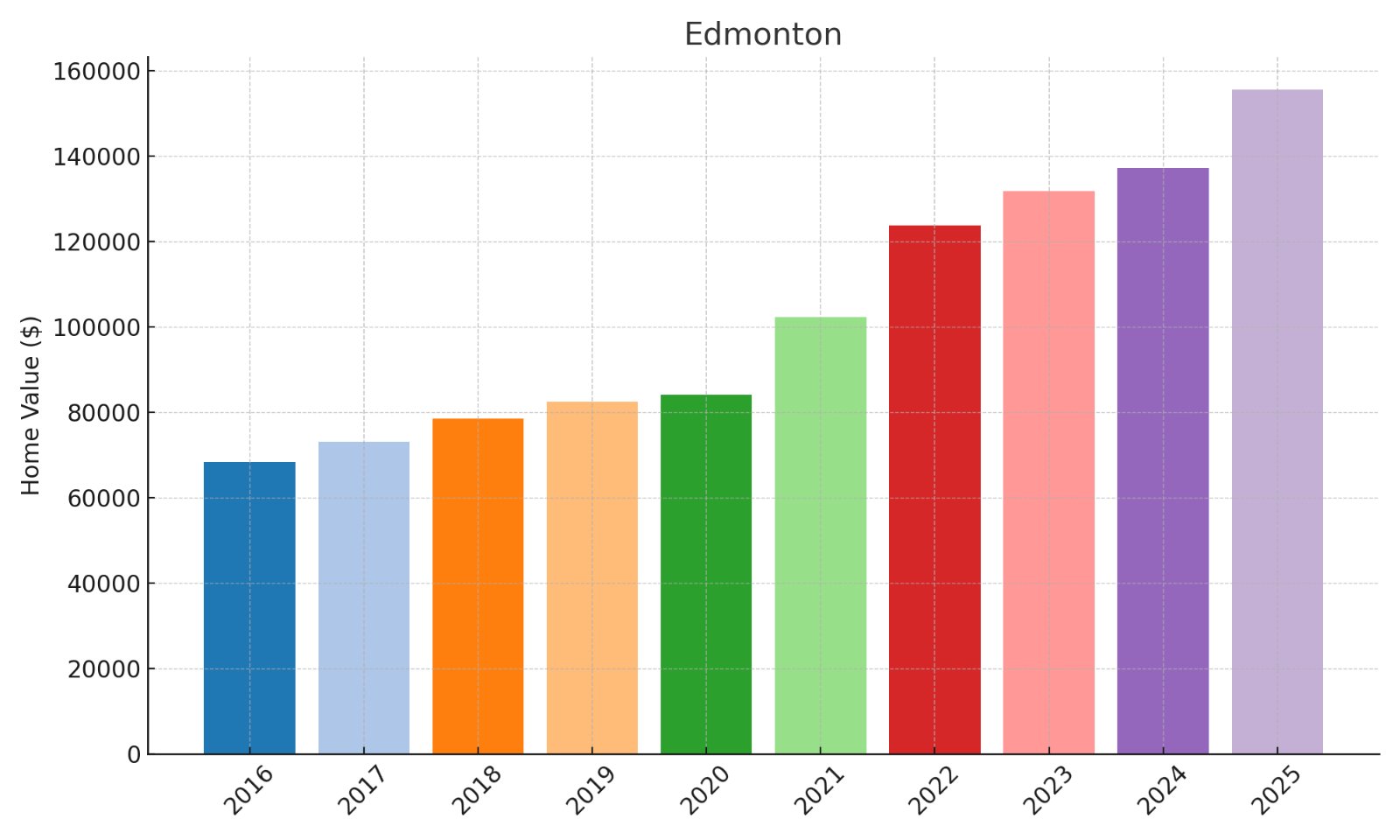

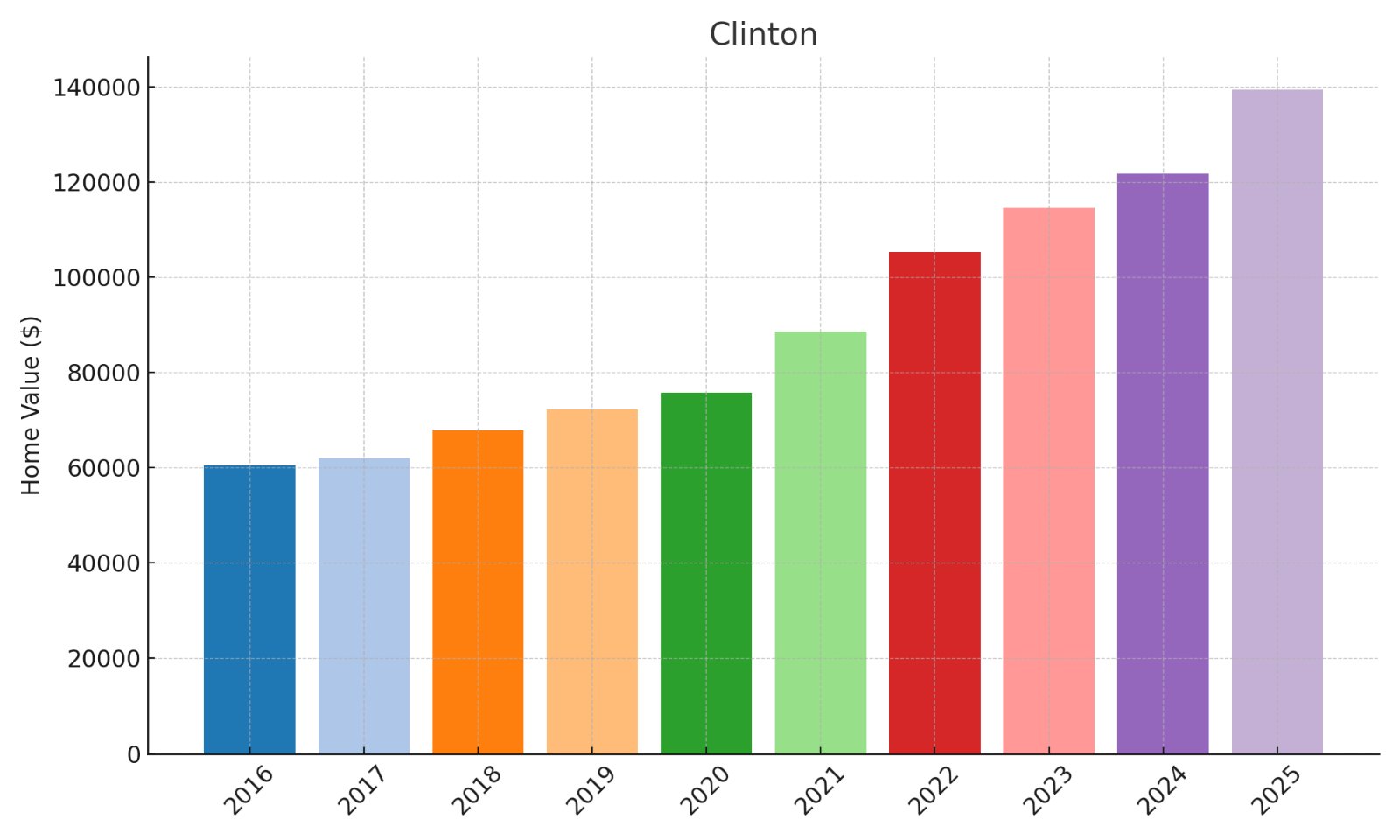

The steady appreciation trajectory accelerated significantly after 2020, indicating fundamental market shifts rather than cyclical factors.

Investment metrics reveal favorable cash-on-cash return potential even at current valuations, suggesting continued opportunity for strategic capital deployment.

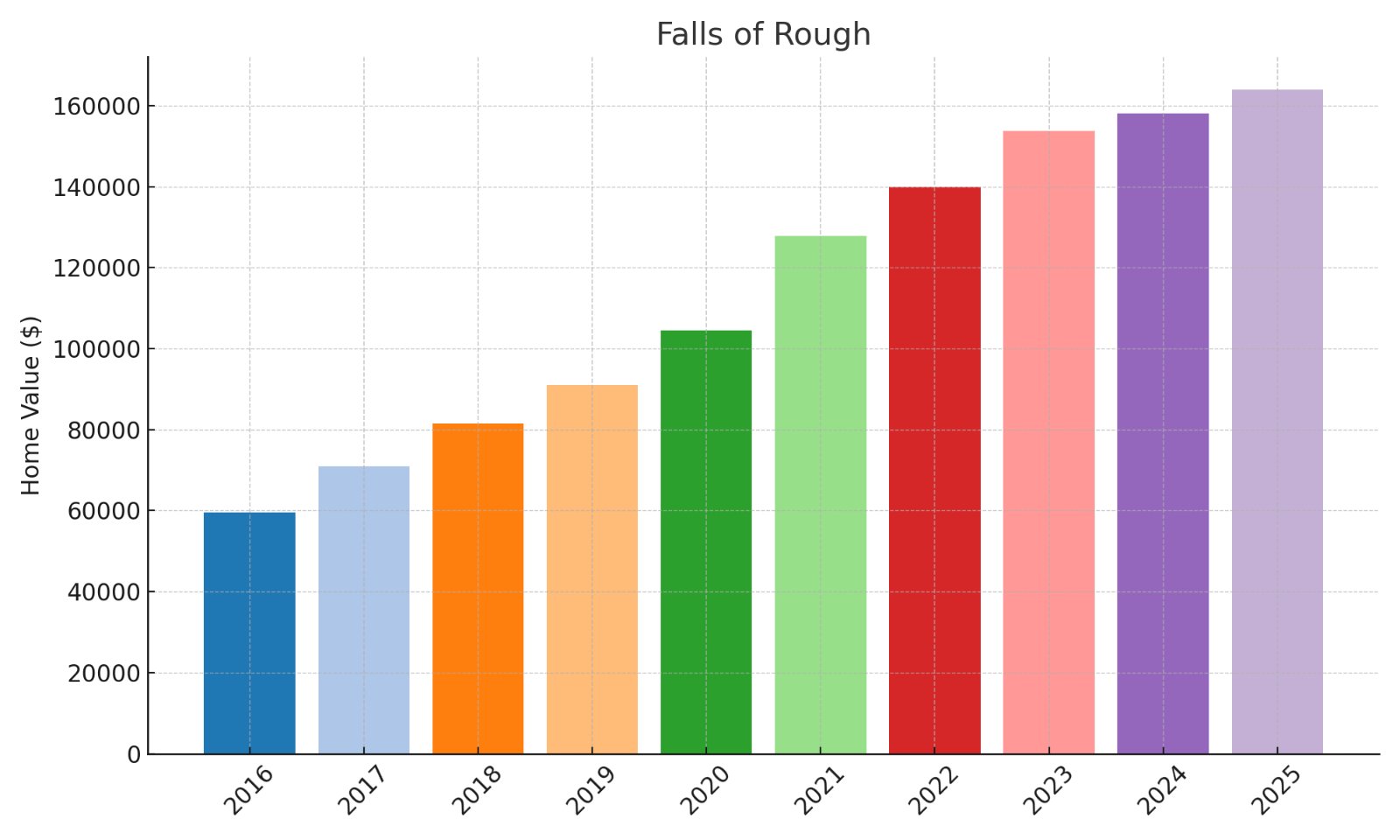

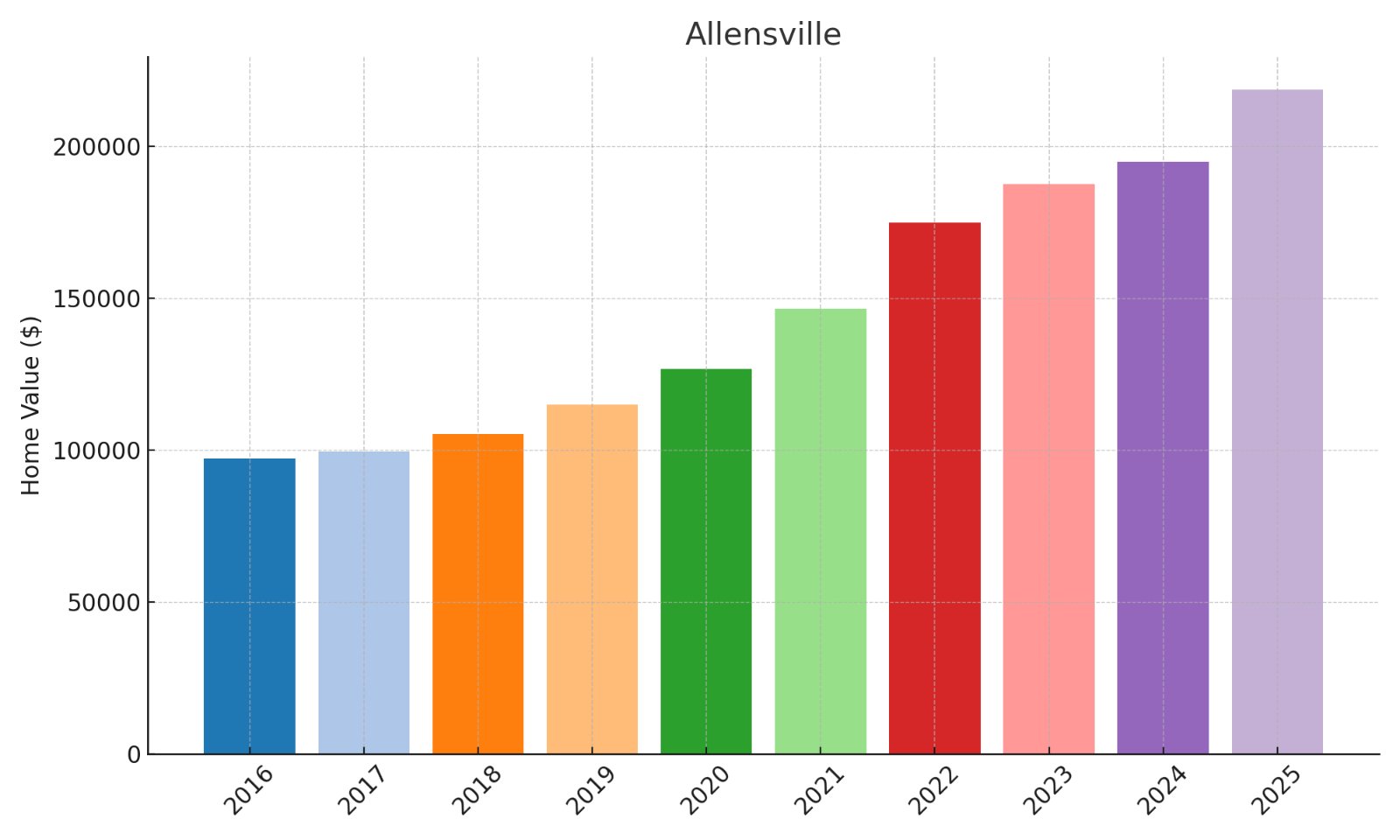

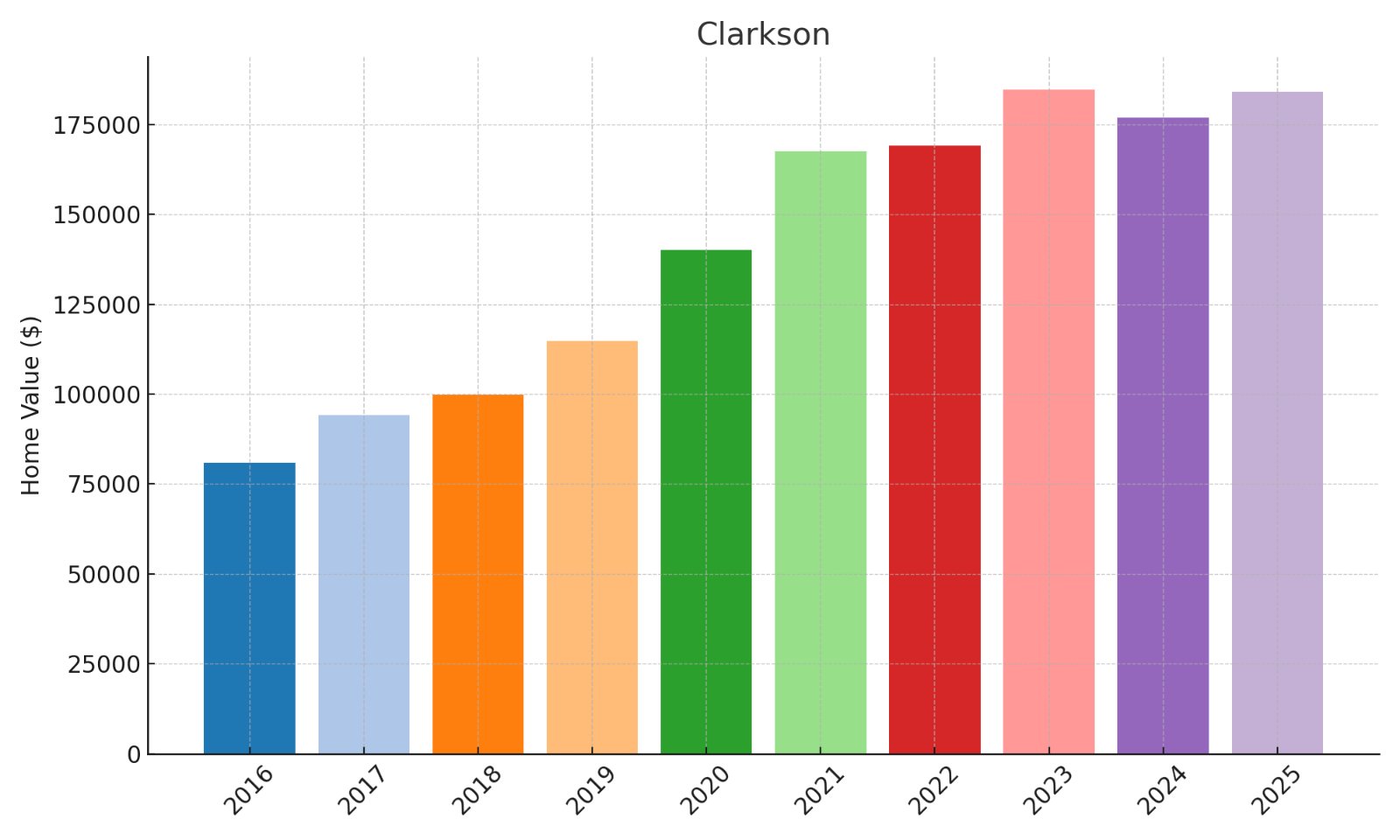

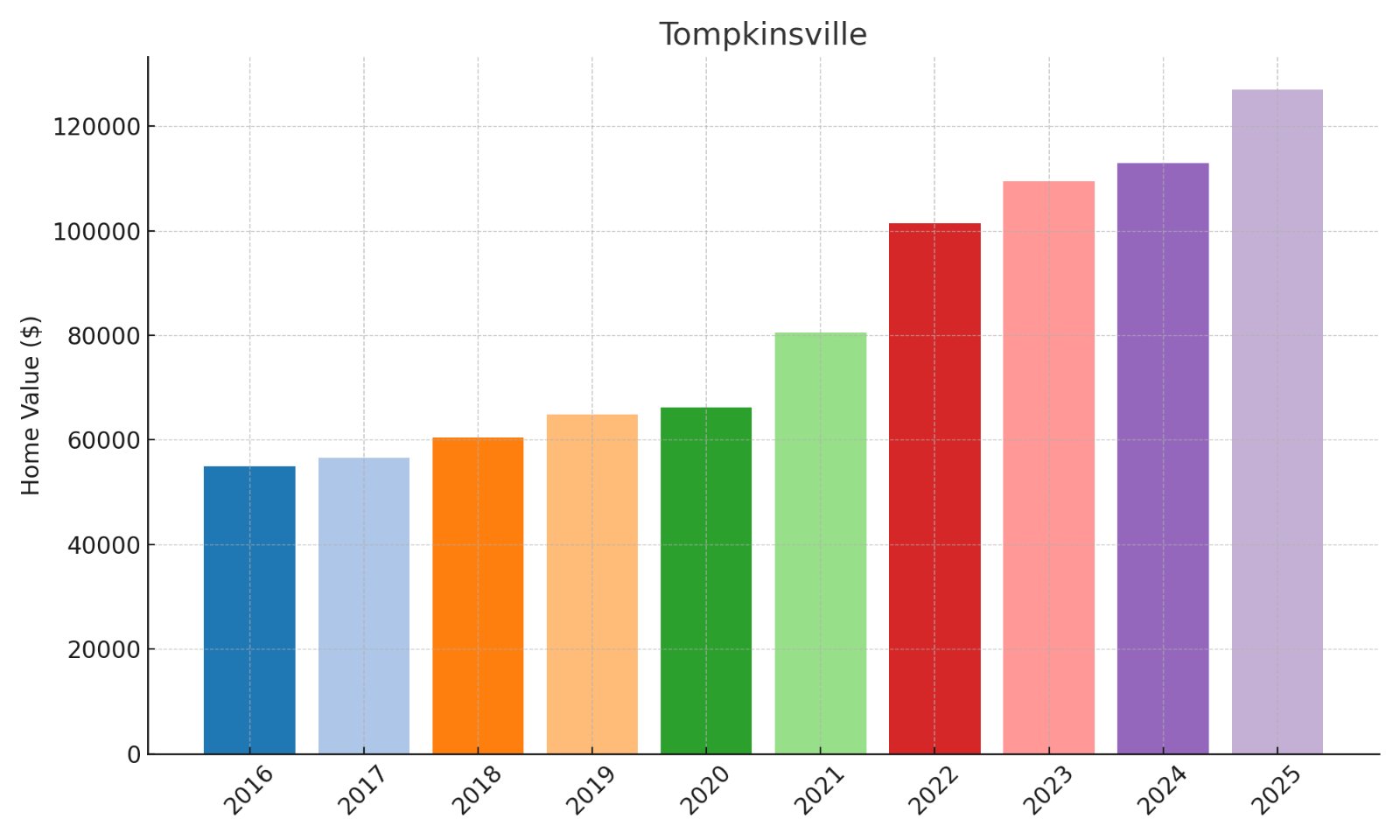

The acceleration in value growth post-2020 indicates fundamental market repositioning rather than temporary factors.

Current price points remain well below replacement costs, suggesting continued upside before reaching construction parity constraints.

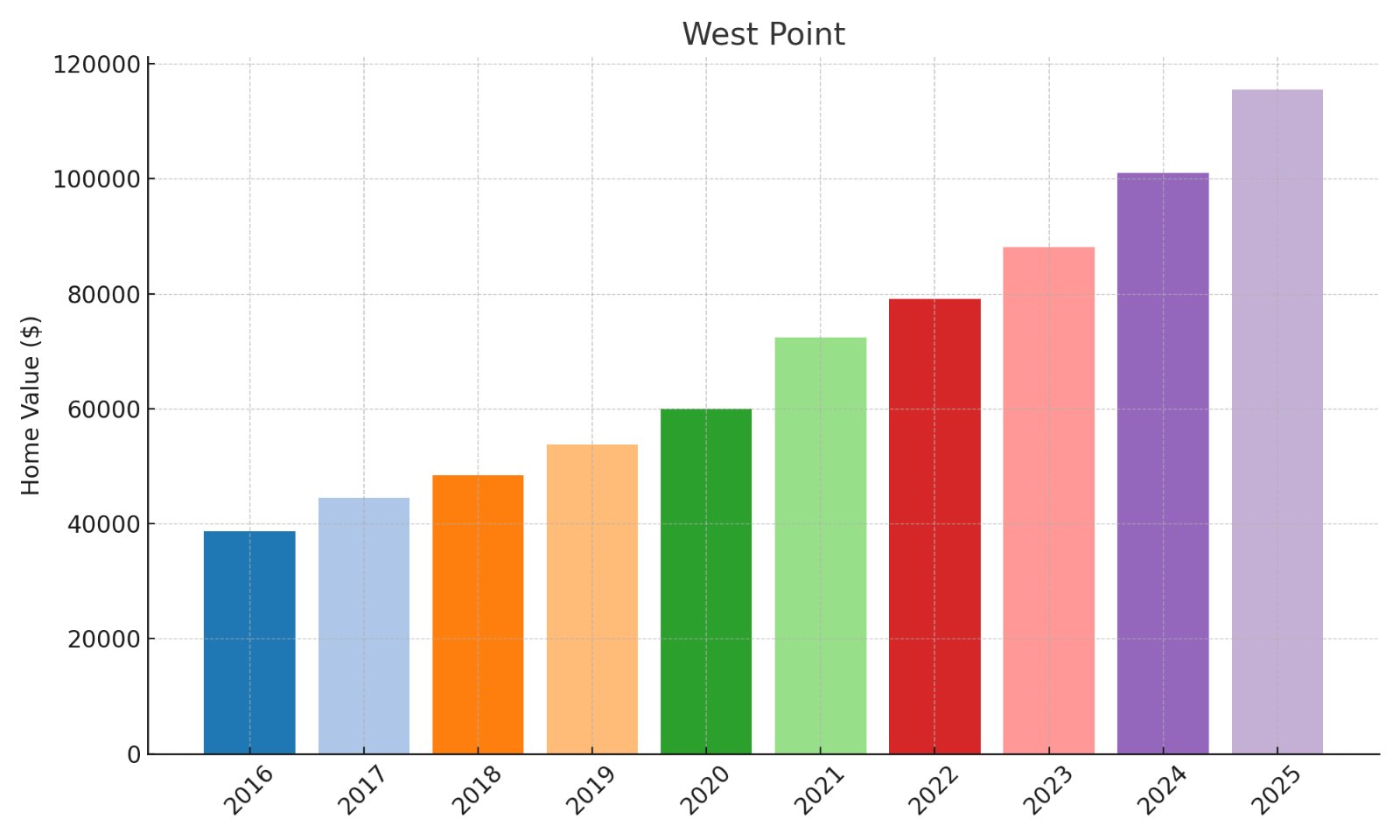

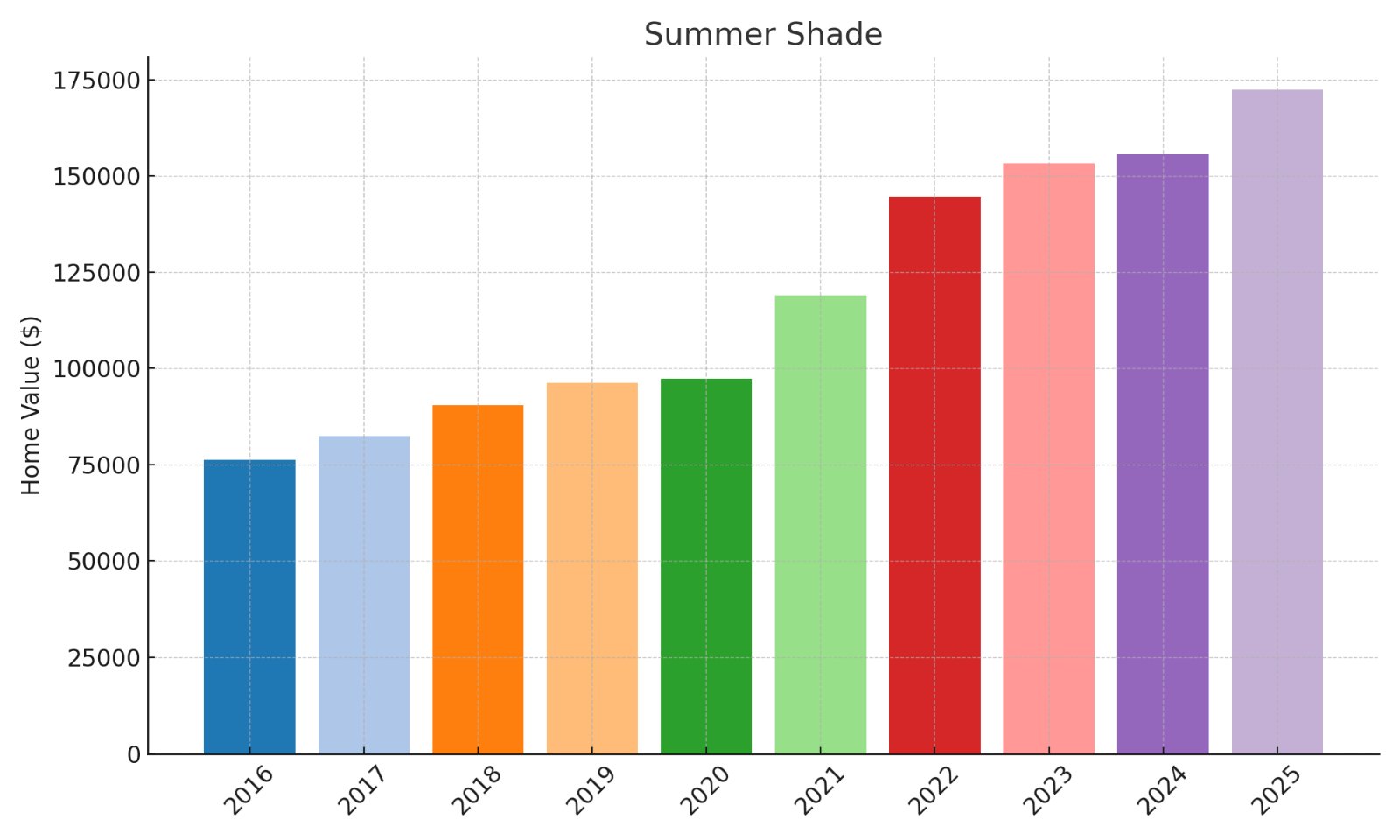

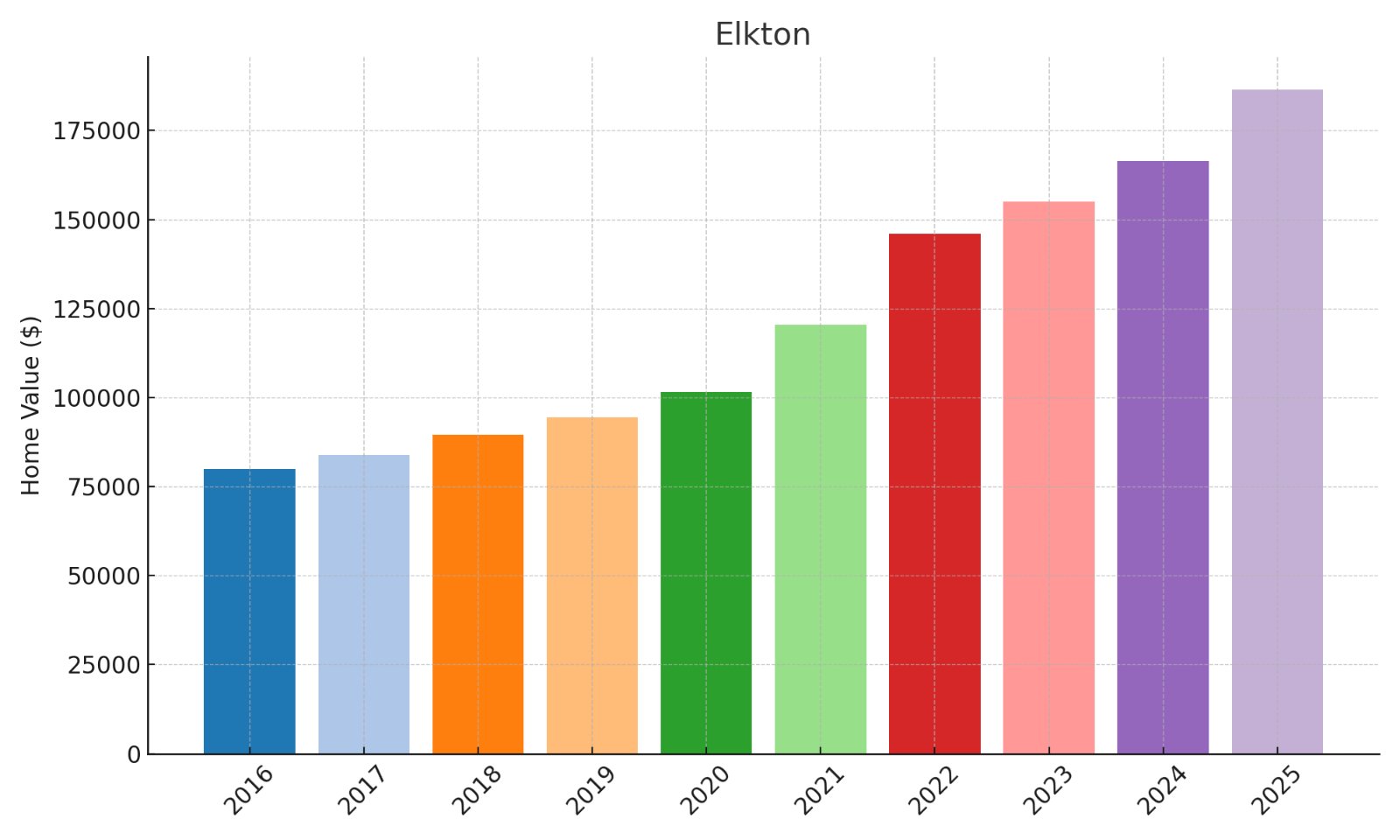

The steady upward trajectory demonstrates remarkable resilience through varying economic conditions and interest rate environments.

Investment analysis reveals favorable debt service coverage ratios despite rising valuations, indicating continued opportunity for leveraged returns.

The dramatic acceleration post-2020 suggests fundamental market shifts driving sustainable value increases rather than speculative activity.

Current valuations remain well below replacement costs, suggesting continued upside potential before reaching construction parity.

The steady appreciation curve accelerated significantly post-2020, indicating fundamental market repositioning rather than cyclical factors.

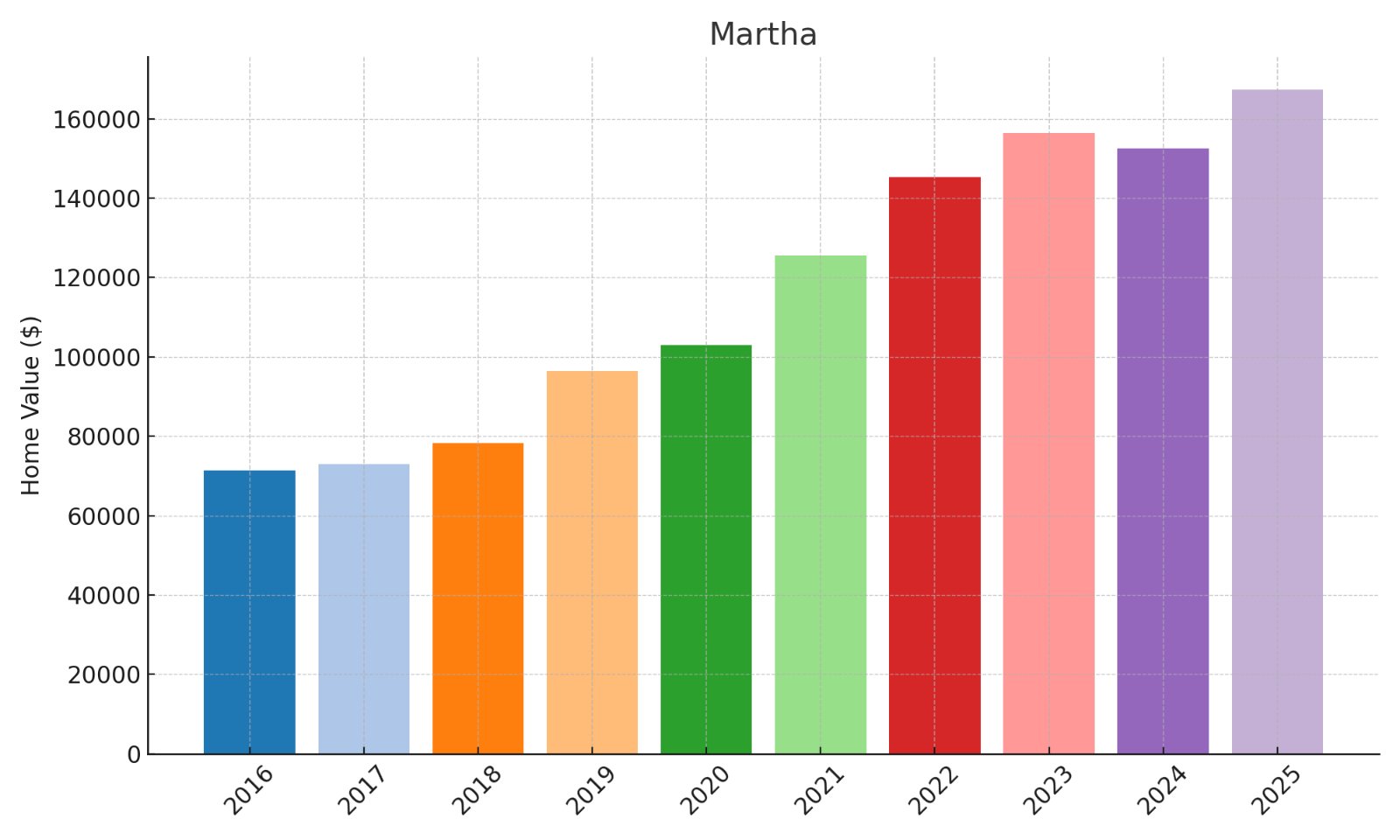

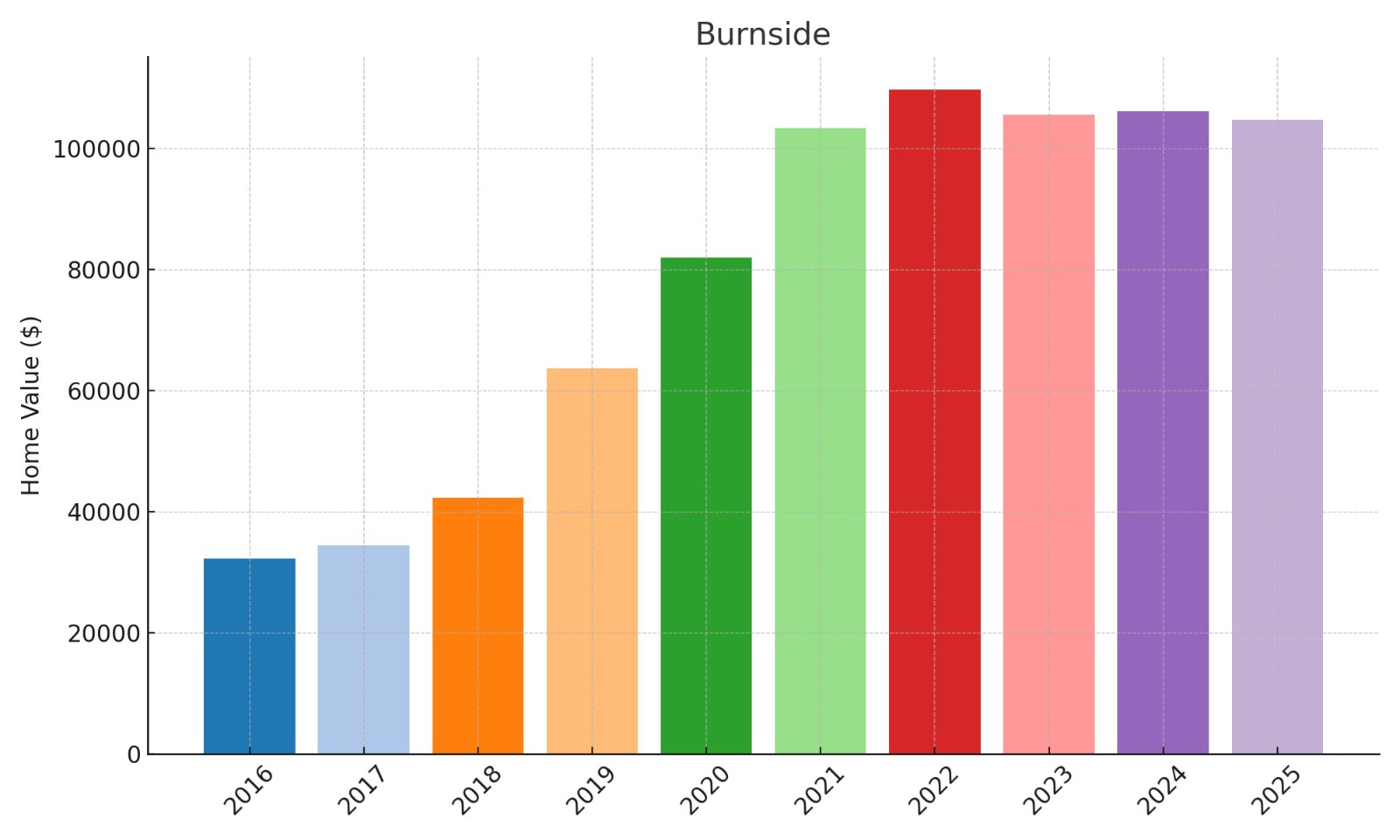

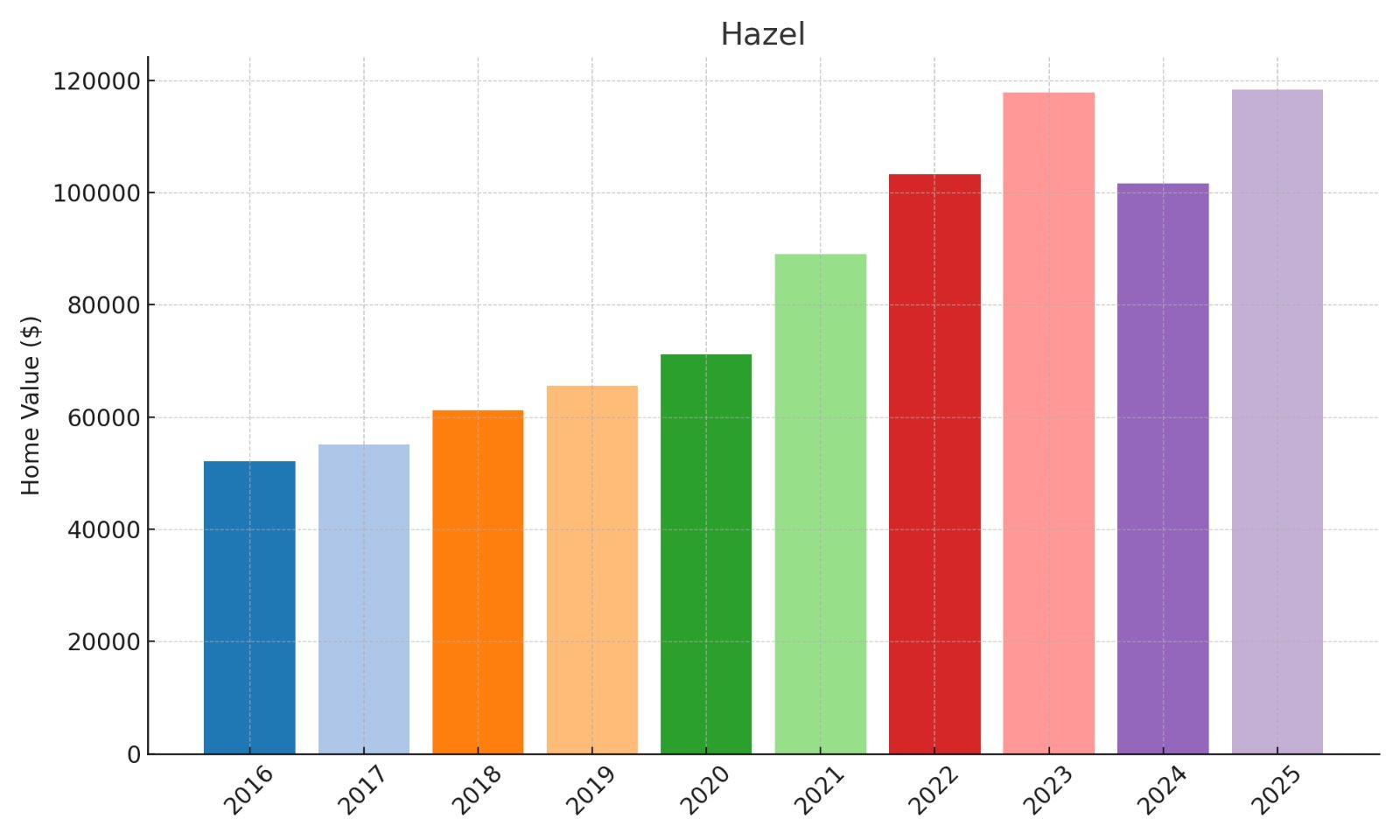

The consistent value growth trajectory, despite a 2023-2024 correction, indicates resilient demand fundamentals rather than speculative forces.

Current valuations remain extraordinarily accessible despite significant appreciation, suggesting continued upside potential.

The market demonstrated remarkable resilience by quickly recovering from a 2023-2024 correction, suggesting strong underlying demand fundamentals.

Investment analysis reveals favorable debt-to-equity optimization potential despite rising valuations, creating opportunities for leveraged returns.

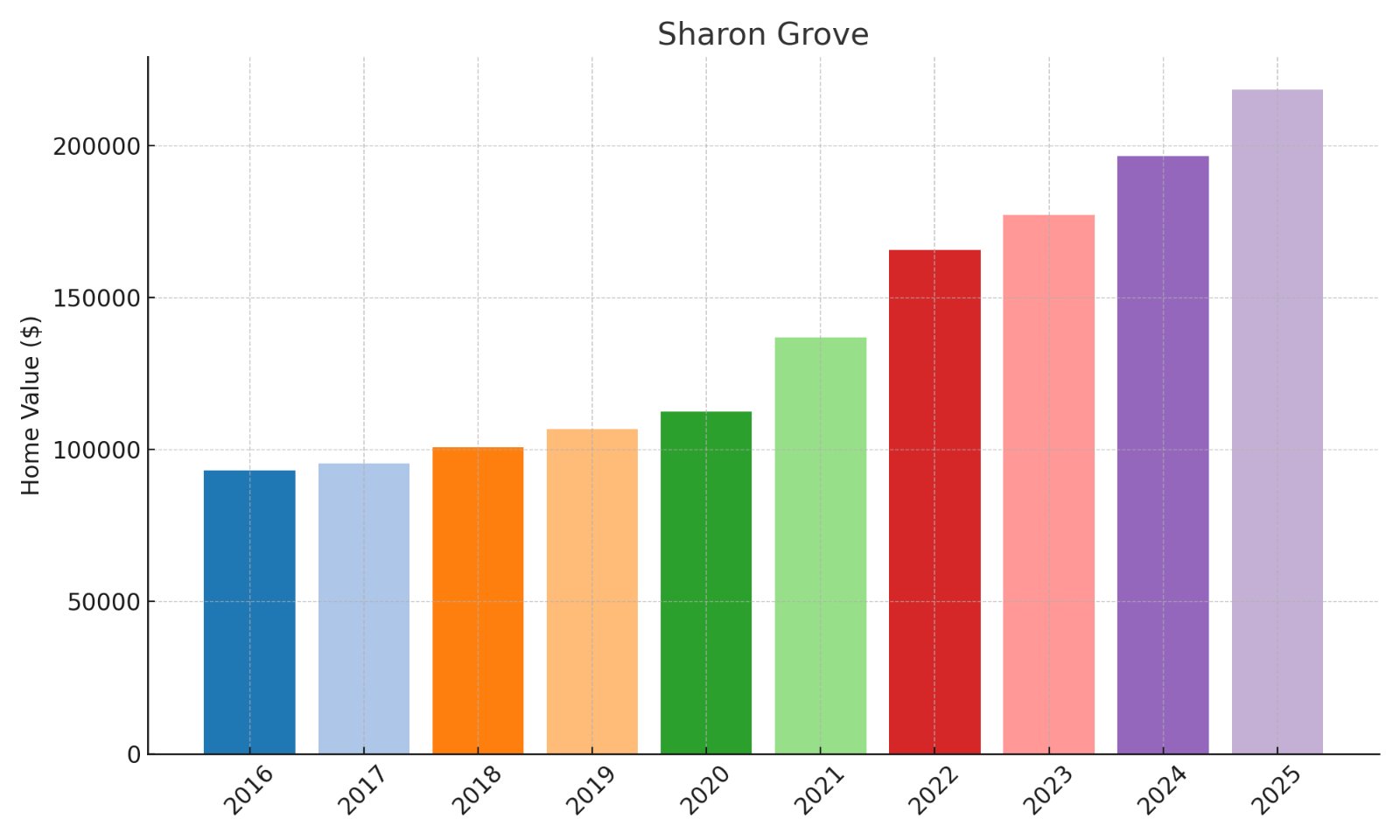

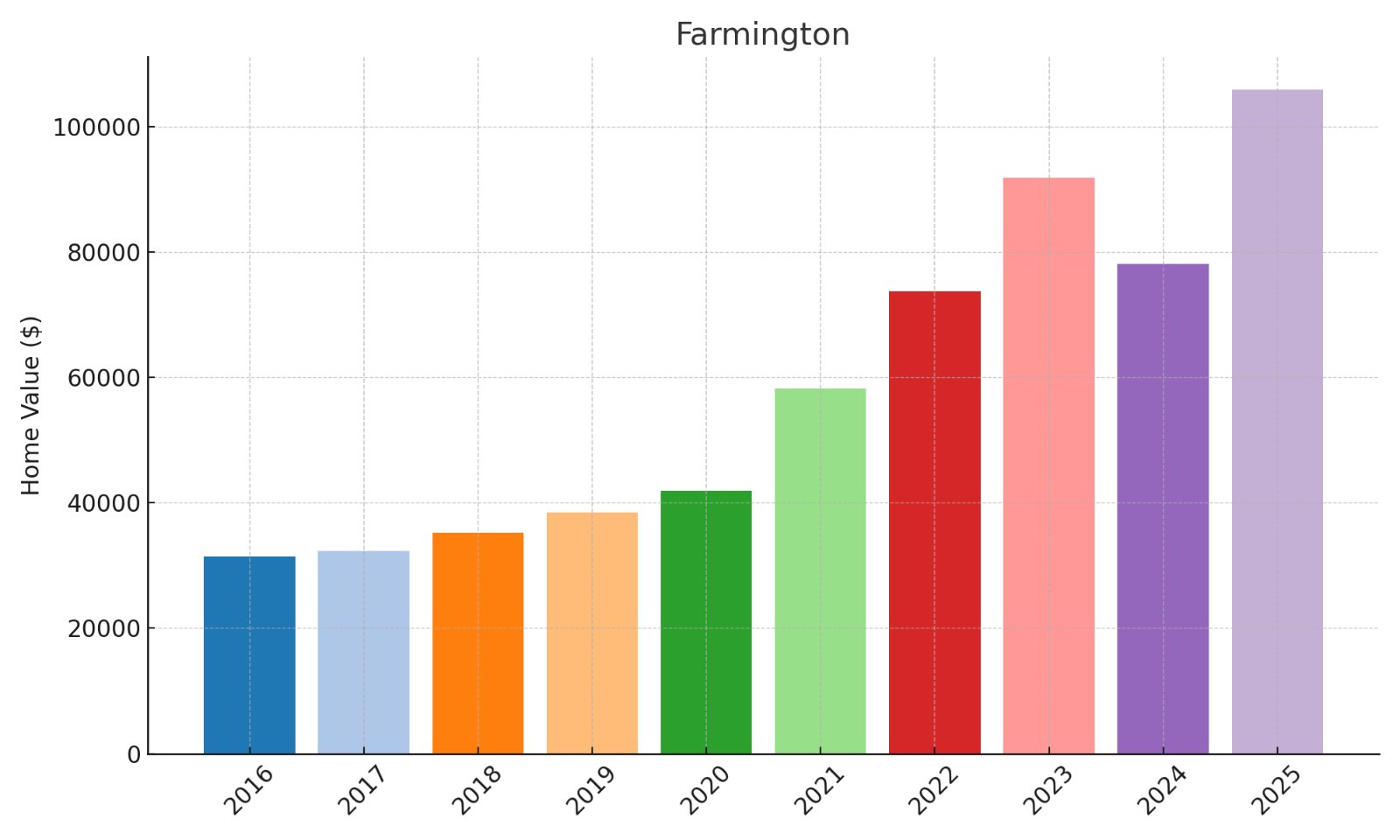

The dramatic acceleration post-2020 indicates fundamental market shifts driving sustainable value increases rather than speculative activity.

Current valuations remain well below replacement costs, suggesting continued upside potential before reaching construction parity.

The consistent year-over-year appreciation pattern accelerated significantly post-2020, indicating strengthening market fundamentals rather than cyclical factors.

Current price points remain well below replacement costs, suggesting continued upside before reaching construction parity.

The steadily accelerating appreciation curve indicates improving market fundamentals rather than speculative forces.

Current valuations remain remarkably affordable despite substantial gains, suggesting continued upside potential before reaching affordability constraints.

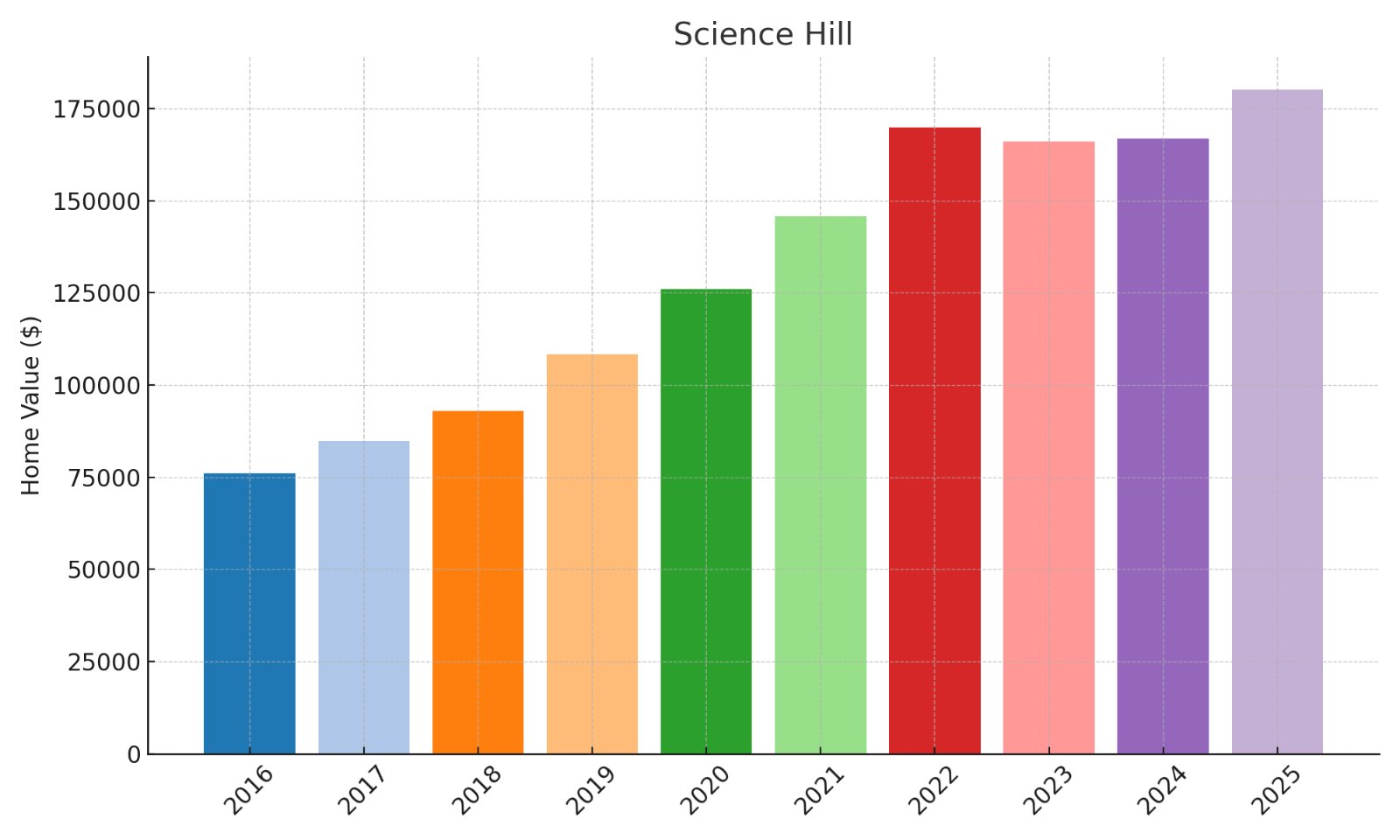

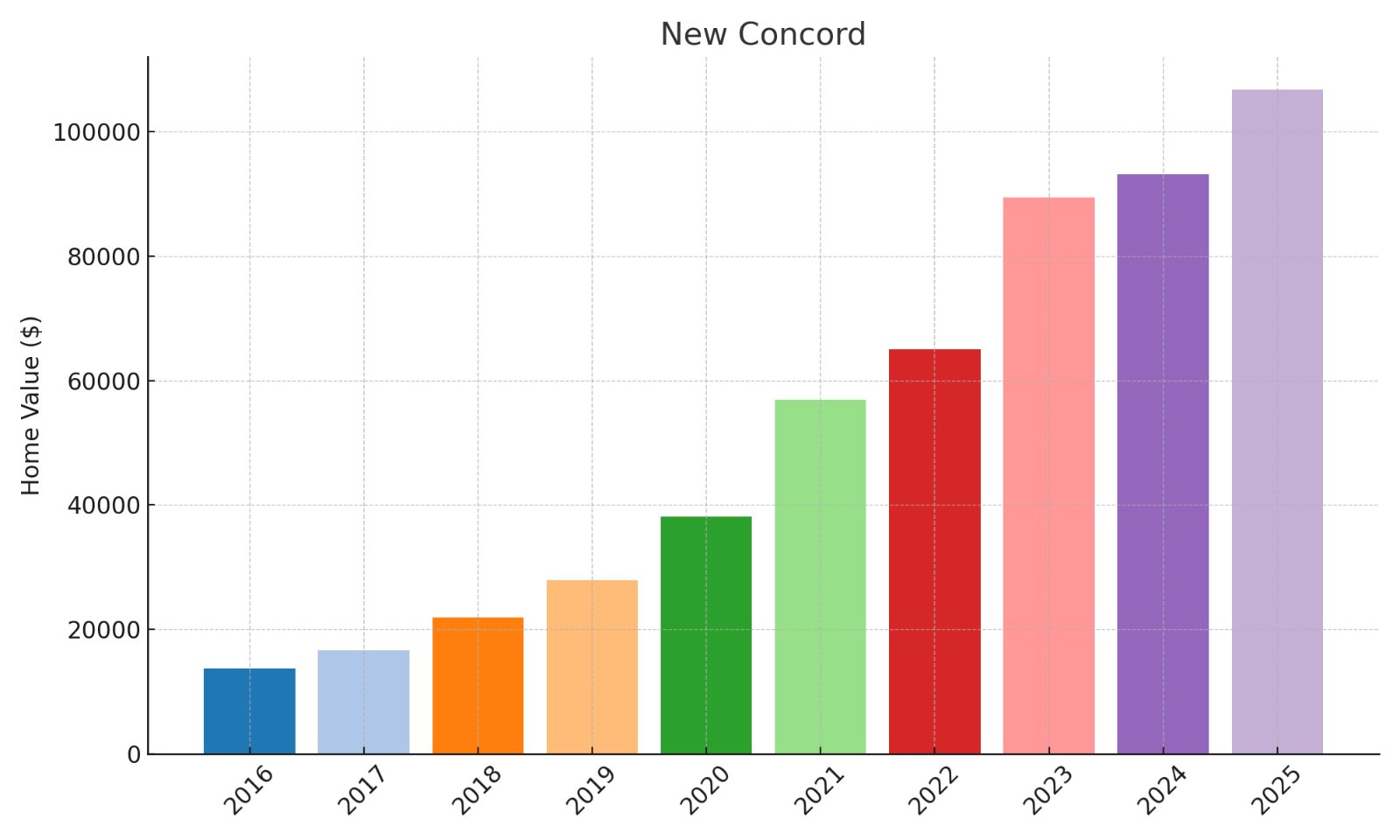

The dramatic acceleration post-2020 indicates fundamental market repositioning rather than cyclical appreciation.

The steady growth trajectory accelerated significantly post-2020, indicating structural market shifts rather than cyclical factors.

Investment metrics show favorable debt service coverage ratios despite rising valuations, suggesting continued opportunity for leveraged returns.

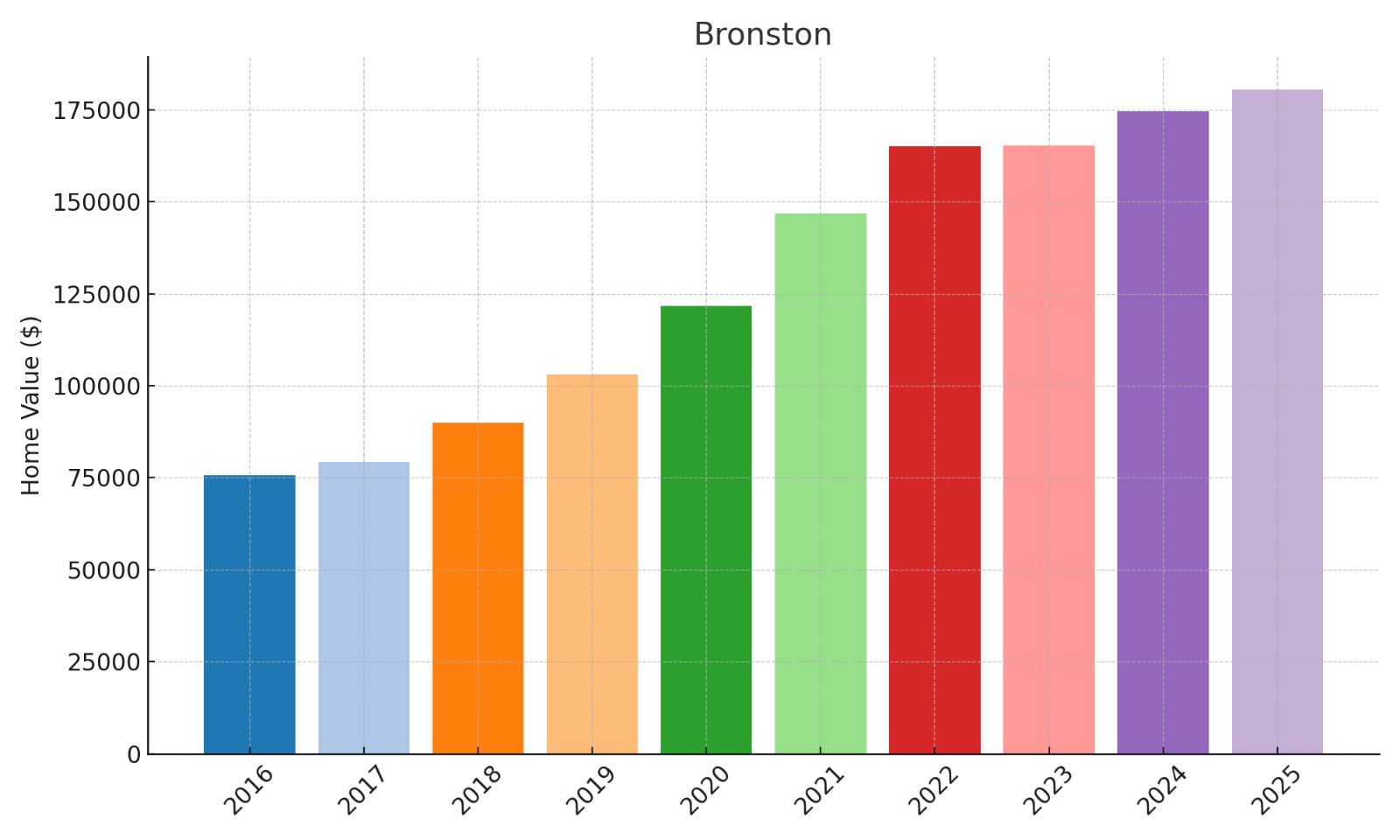

The dramatic acceleration post-2020 indicates fundamental market repositioning rather than cyclical factors.

Current valuations remain well below replacement costs, suggesting continued upside before reaching construction parity limits.

The market showed impressive resilience by quickly recovering from a 2023-2024 correction, suggesting strong underlying demand fundamentals.

Investment analysis reveals favorable price-to-rent ratios despite substantial appreciation, indicating continued opportunity for cash flow investors.

The steady acceleration in appreciation rates indicates strengthening market fundamentals rather than approaching saturation.

Investment metrics reveal favorable debt-to-equity optimization potential for leveraged purchases despite rising valuations.

The market demonstrated remarkable resilience by stabilizing after a minor 2022-2023 correction before resuming its upward trajectory.

Investment analysis shows favorable cash-on-cash return potential even at current valuations, suggesting continued opportunity for strategic capital deployment.

Current valuations remain below replacement costs, suggesting continued upside potential before reaching construction parity.

Investment metrics reveal favorable price-to-income ratios despite substantial appreciation, indicating continued upside potential.

The consistent acceleration in growth rates post-2019 indicates strengthening market fundamentals rather than temporary factors.

Investment analysis reveals favorable debt service coverage ratios despite rising valuations, creating opportunities for leveraged returns.

The dramatic and consistent value increases indicate fundamental market repositioning rather than speculative forces.

Current valuations remain well below replacement costs, suggesting continued upside potential before reaching construction parity.

The consistent year-over-year acceleration in growth rates indicates strengthening market fundamentals rather than approaching saturation.

Current valuations remain extraordinarily accessible despite significant appreciation, suggesting substantial continued upside potential.

Investment analysis reveals unprecedented percentage returns relative to capital deployed, far outpacing traditional investment vehicles.

Current valuations remain extraordinarily accessible despite this remarkable growth, suggesting continued upside potential.

The consistent year-over-year acceleration demonstrates fundamental market repositioning rather than temporary factors.