Ive analyzed theZillow Home Value Indexdata to uncover the fastest-growing towns in Colorado from 2016 to 2025.

Beyond the well-known ski hubs and mountain retreats, this list surfaces communities where home values have quietly surged.

Some of these markets have seen home prices more than double in under a decade.

Home Stratosphere | Leaflet

This list of 25 towns highlights opportunities where equity is building fast.

Its a data-driven look at where value is risingand where investors and buyers might want to look next.

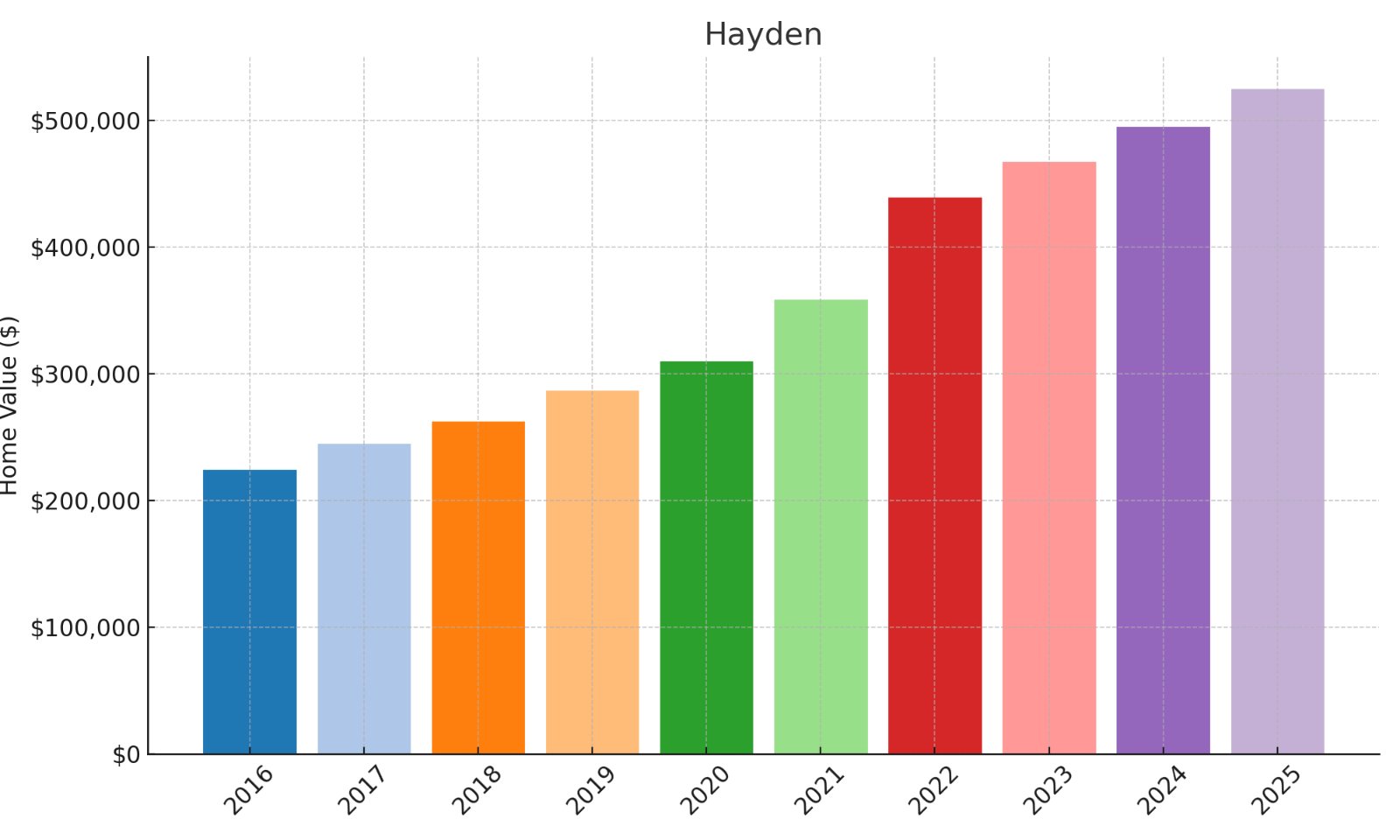

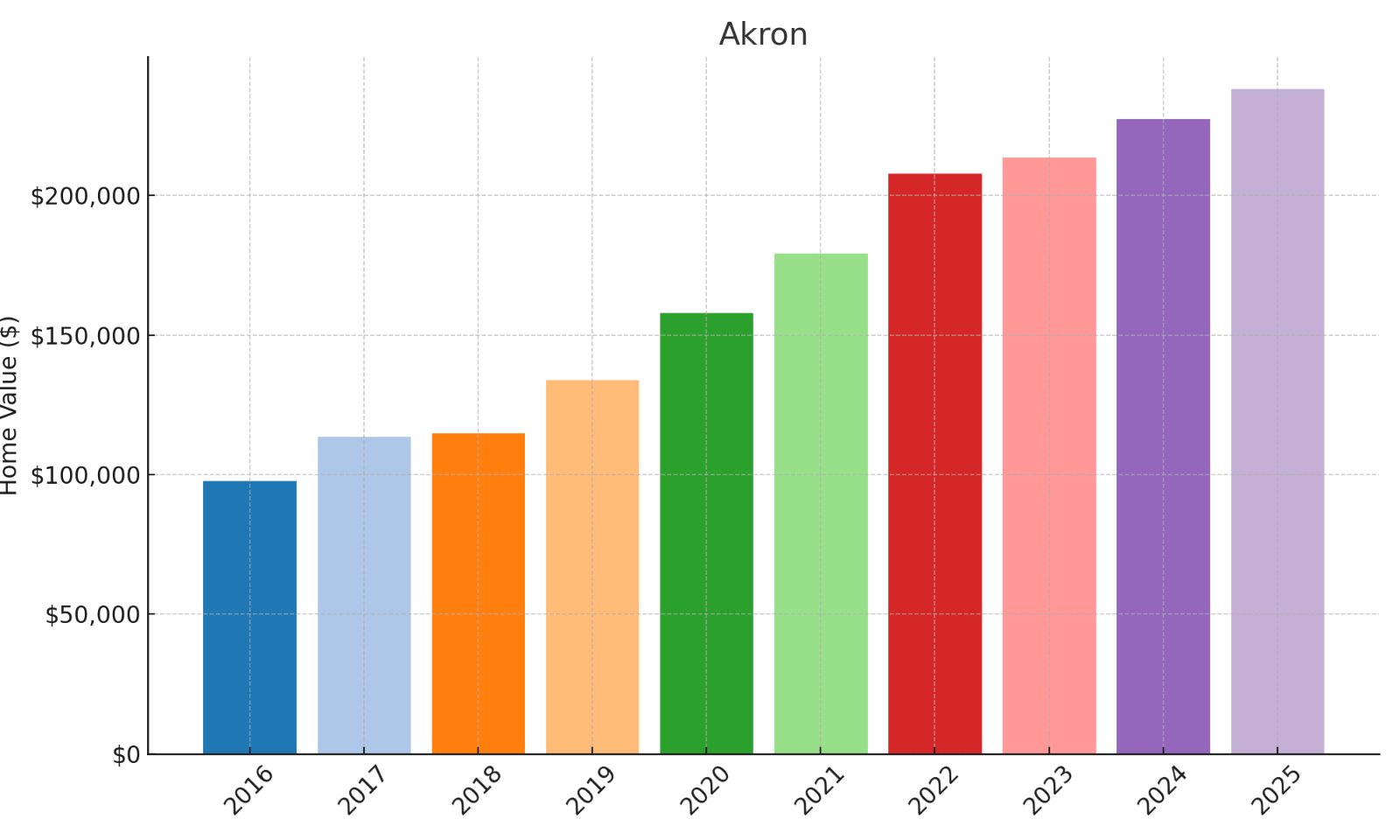

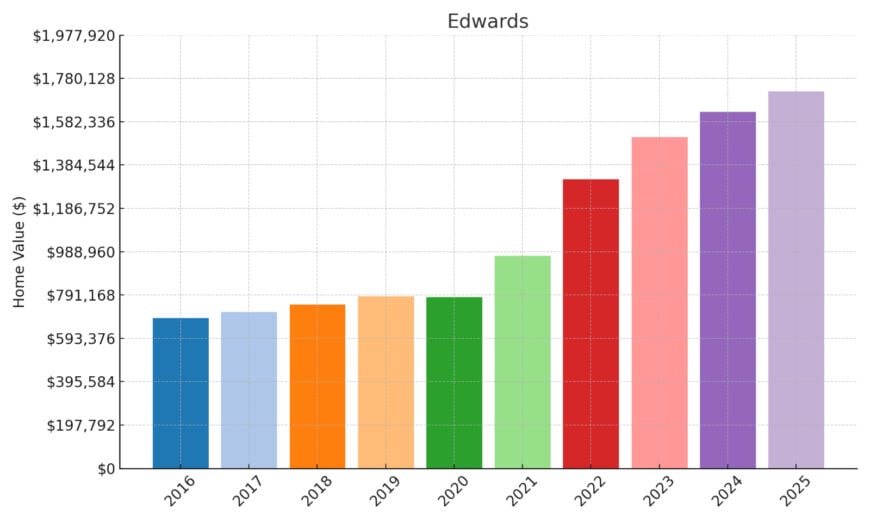

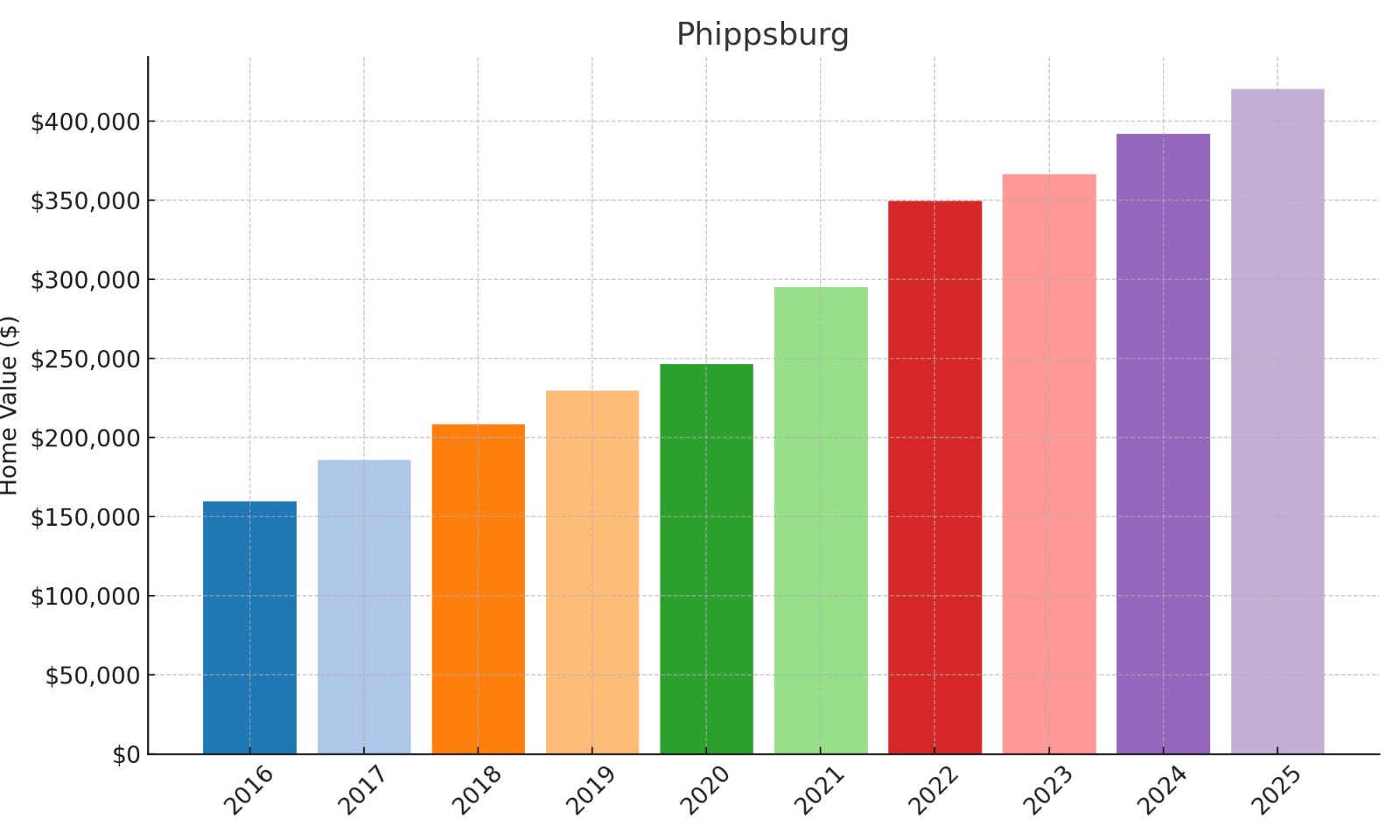

The steady 9.9% annual returns consistently outpaced inflation across all measurement years.

Strong 22.5% growth during 2021-2022 created significant equity during the pandemic mountain boom.

Proximity to Steamboat Springs offers similar recreational access at a relative value proposition.

Continued appreciation through 2023-2025 confirms sustainable demand beyond pandemic speculation.

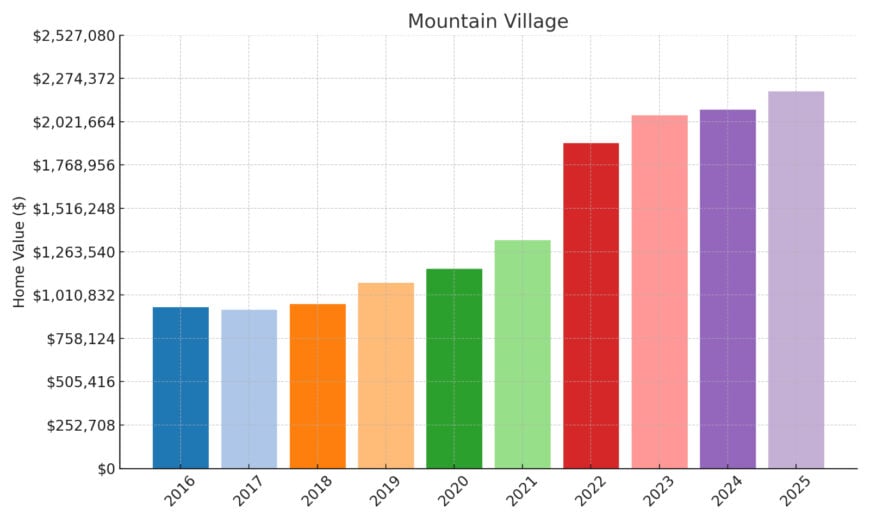

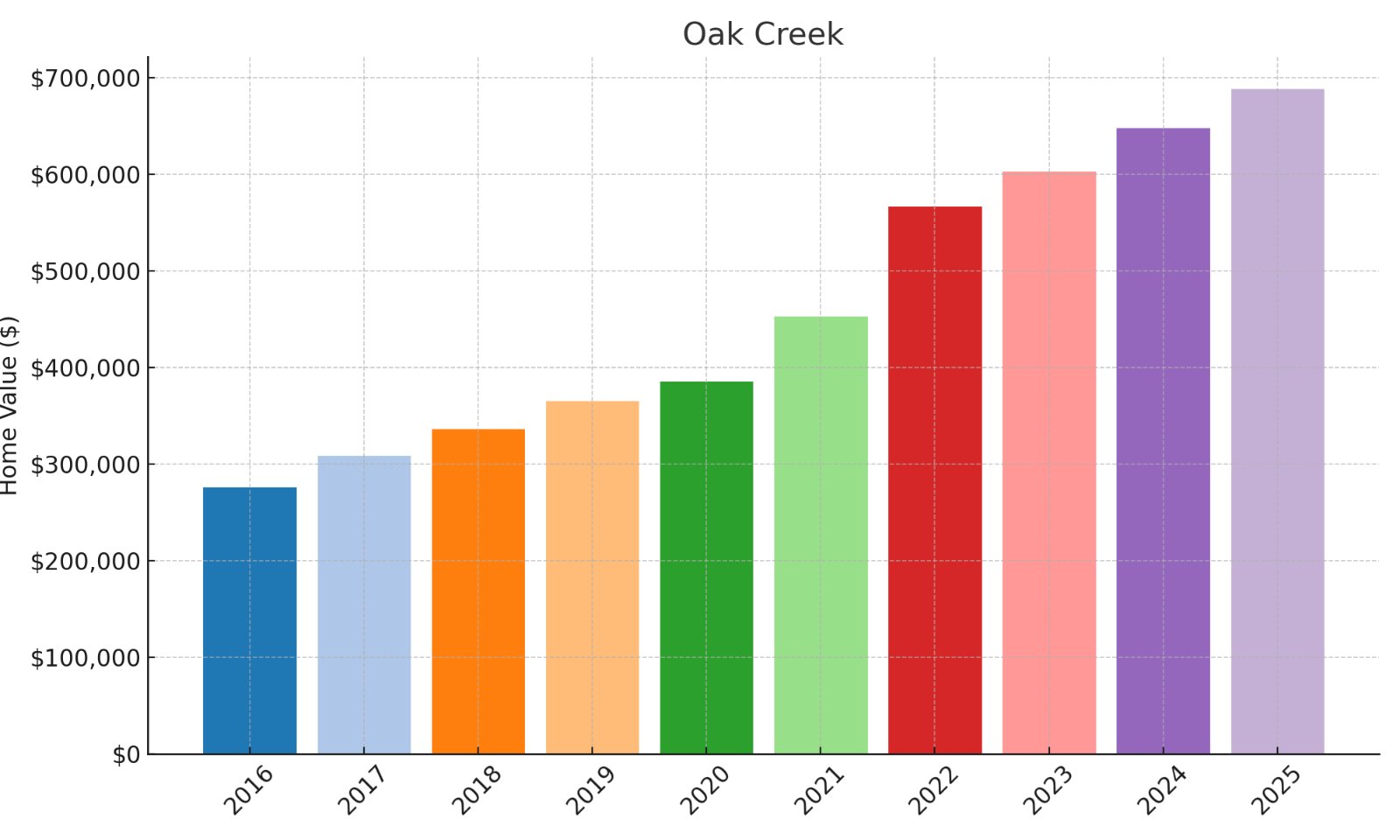

After a minor dip in 2017, the market exploded with 42.6% growth during 2021-2022 alone.

This Telluride-adjacent community combines significant appreciation with premier rental income potential.

Continued growth of 16% after 2022 shows resilience when many luxury markets plateaued.

World-class skiing and limited inventory support long-term value in this exclusive mountain enclave.

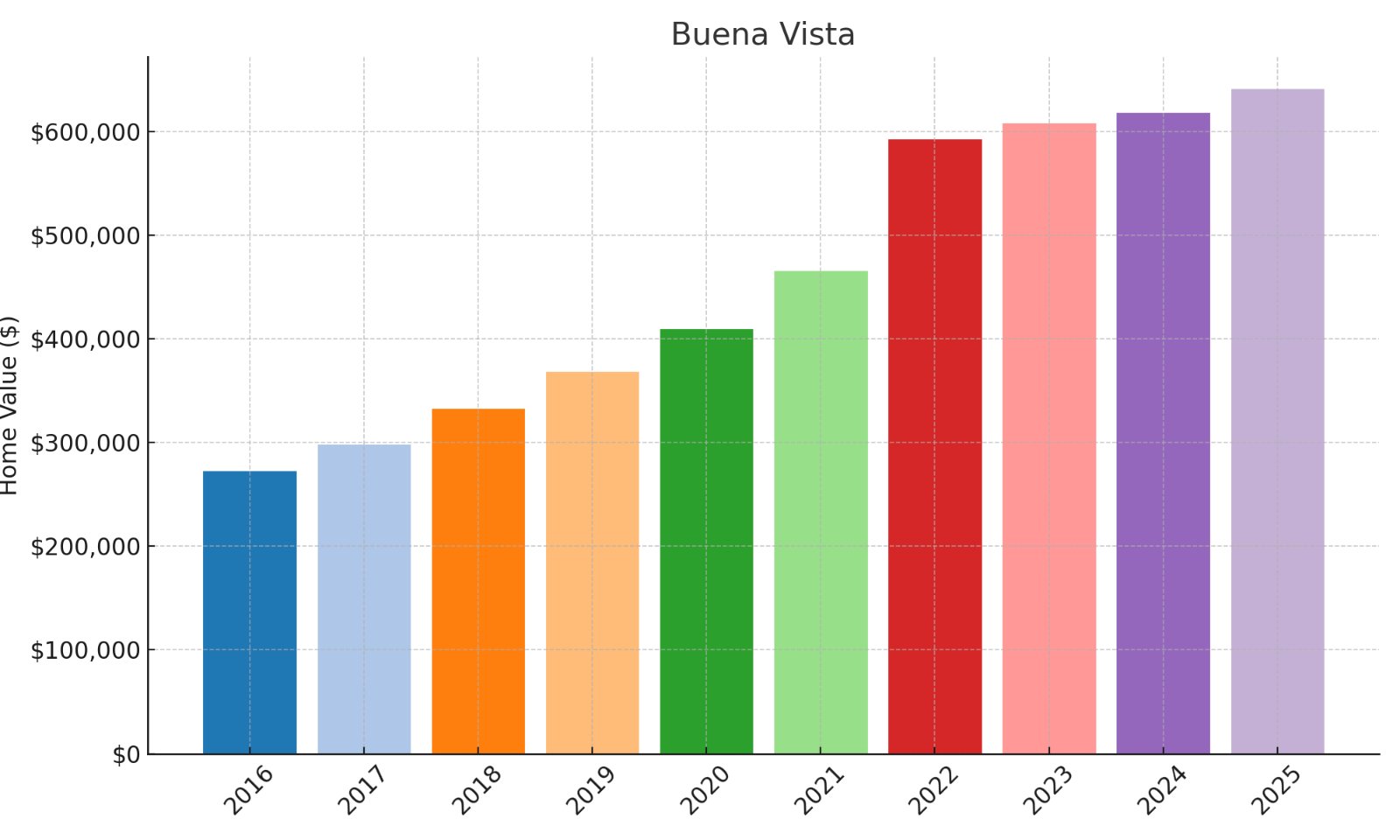

Strong 27.2% growth during 2021-2022 accelerated equity gains during the pandemic mountain boom.

This scenic valley town offers outdoor recreation appeal with relative affordability versus ski destinations.

Continued 8.2% growth after 2022 confirms sustainable demand beyond pandemic-driven speculation.

Strategic position near Collegiate Peaks provides both summer and winter recreational opportunities.

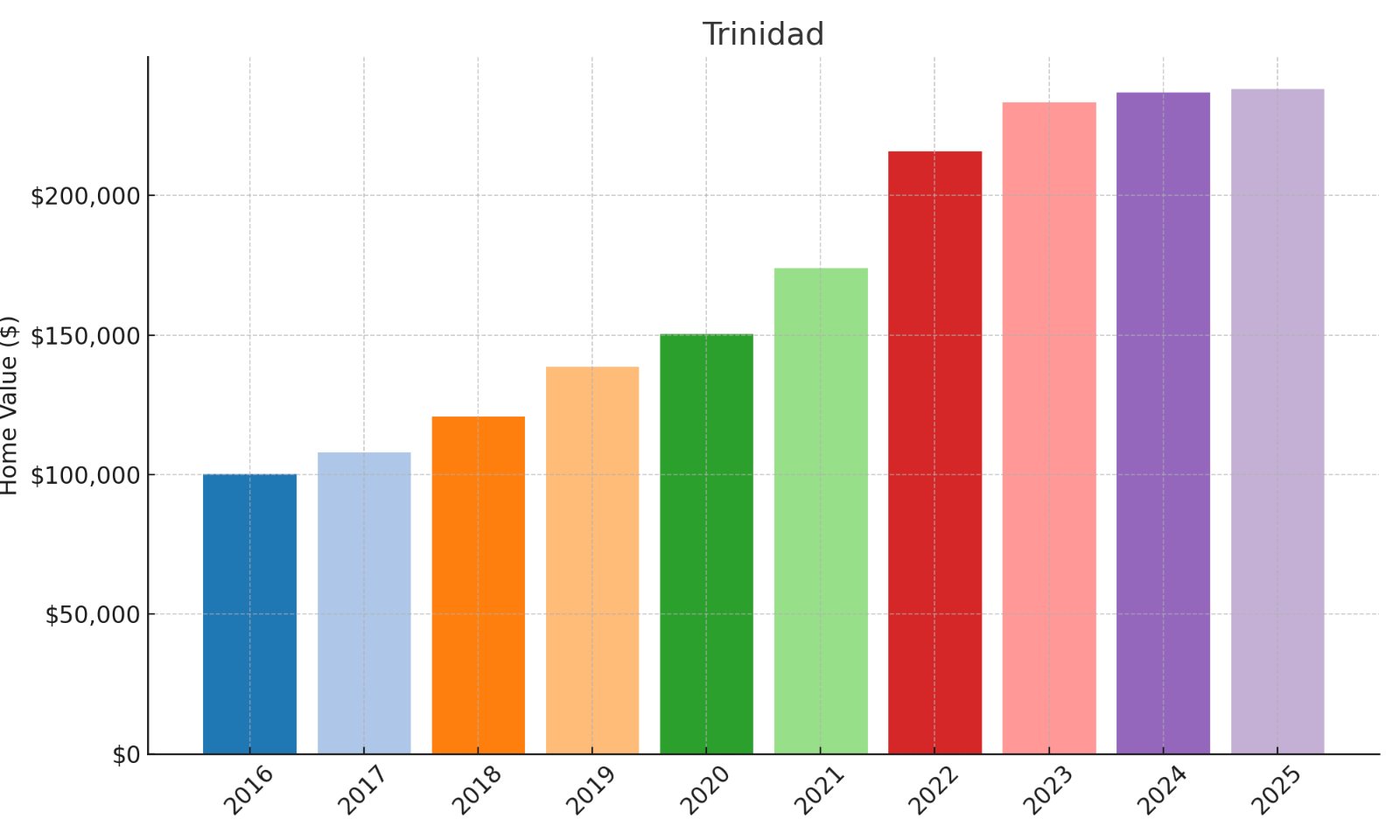

Trinidad

Trinidads 137.8% growth transformed a $100K investment into $238K, generating $138K in wealth.

A modest $20K down payment would control an asset that produced nearly 7x that in equity.

The historic southern Colorado town showed consistent growth across all measurement years.

Strong performance during 2021-2022 (24.1% growth) created significant pandemic-era equity gains.

Recent stability suggests a sustainable equilibrium as remote workers discover its historic charm.

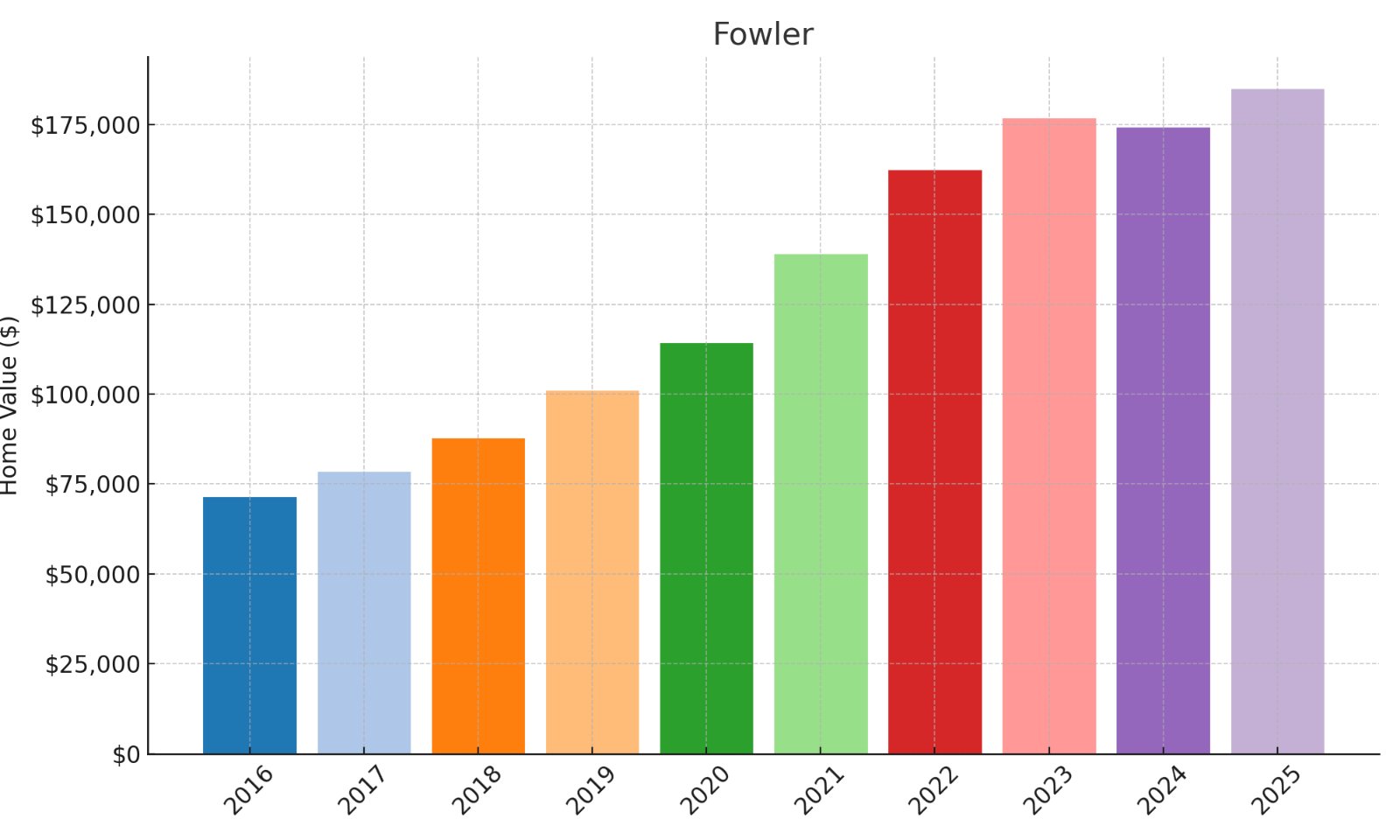

The impressive 28.2% surge during 2020-2021 came during the pandemic rural relocation wave.

Despite a 5.6% correction in 2024, the market rebounded strongly with 12.1% growth in 2025.

A minimal $13.9K down payment would control an asset generating 7x that amount in equity.

This southeastern Colorado town demonstrates the wealth-building power of affordable markets.

Florence

Florences steady 140.8% growth transformed $116K into $280K, creating $164K in wealth.

This historic town showed remarkable consistency with positive growth every single year.

Strong 16.8% growth during 2020-2021 accelerated during the pandemic relocation wave.

A 10.6% annual growth rate substantially outpaced inflation while maintaining affordable carrying costs.

Continued upward trajectory suggests sustainable appeal as buyers seek small-town affordability.

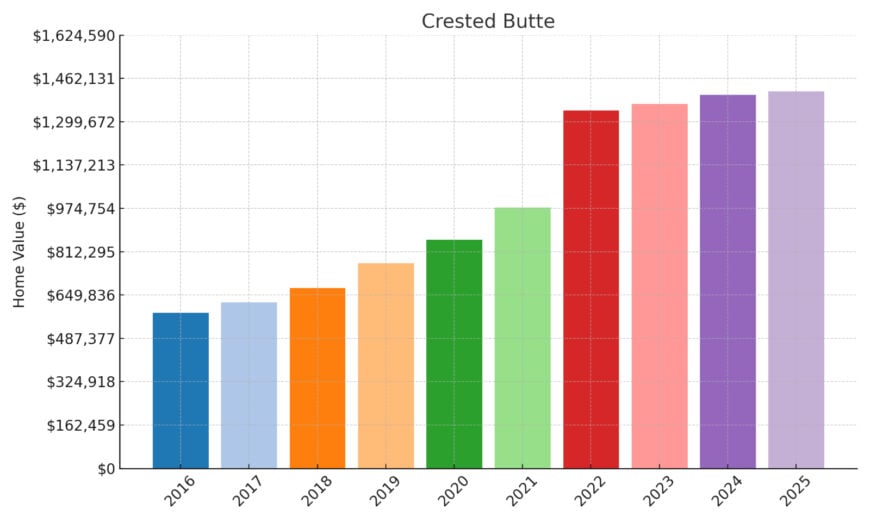

The extraordinary 47.9% surge in 2022 created massive equity during the pandemic luxury boom.

Despite a 5.8% correction in 2024, prices rebounded 4.7% in 2025, showing remarkable resilience.

The substantial 22.1% surge during 2020-2021 capitalized on pandemic rural relocation trends.

Despite a minor 0.3% correction in 2023, the market quickly resumed growth, showing resilience.

A modest $15.6K down payment would control an asset generating 7x that amount in equity.

This affordable southern Colorado town offers value as remote workers discover smaller markets.

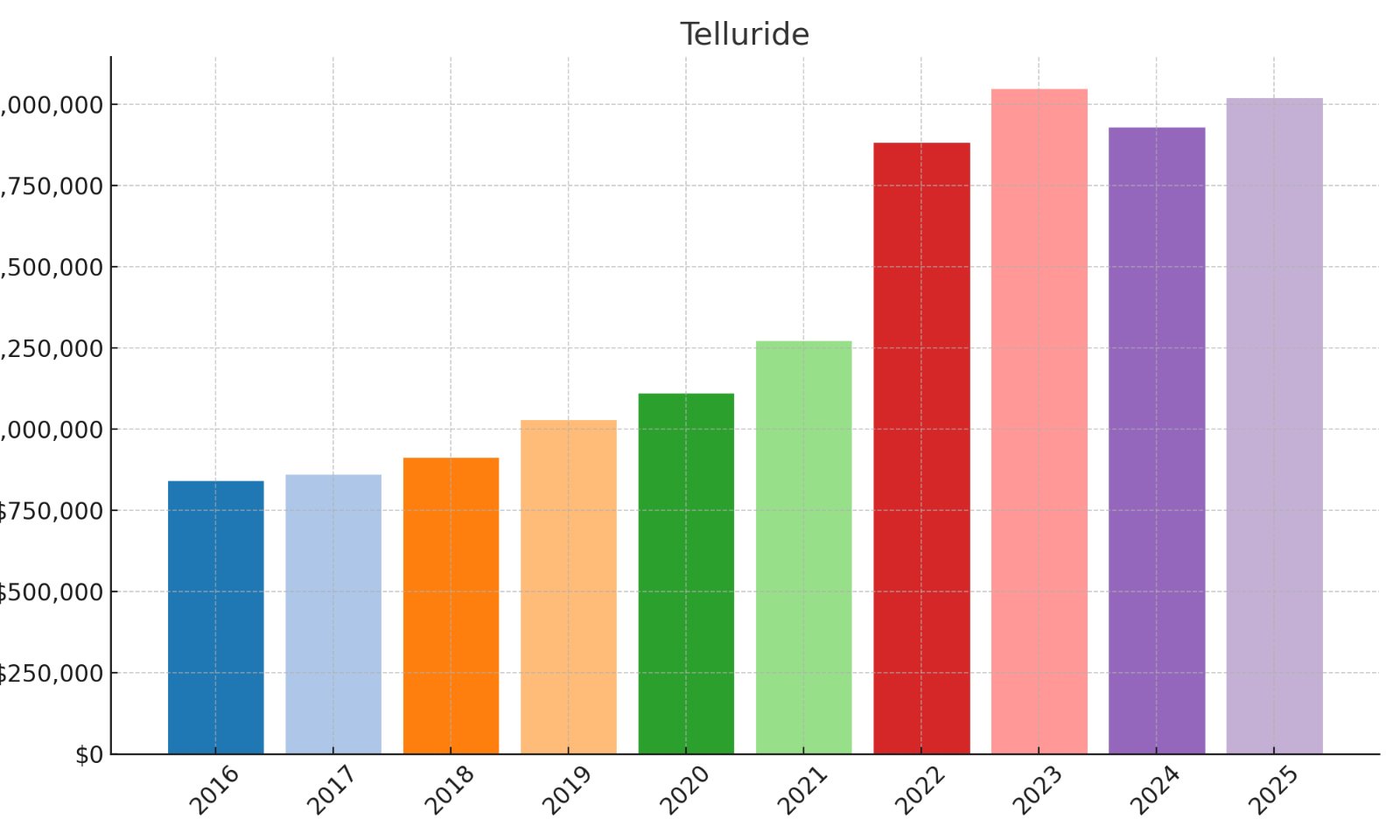

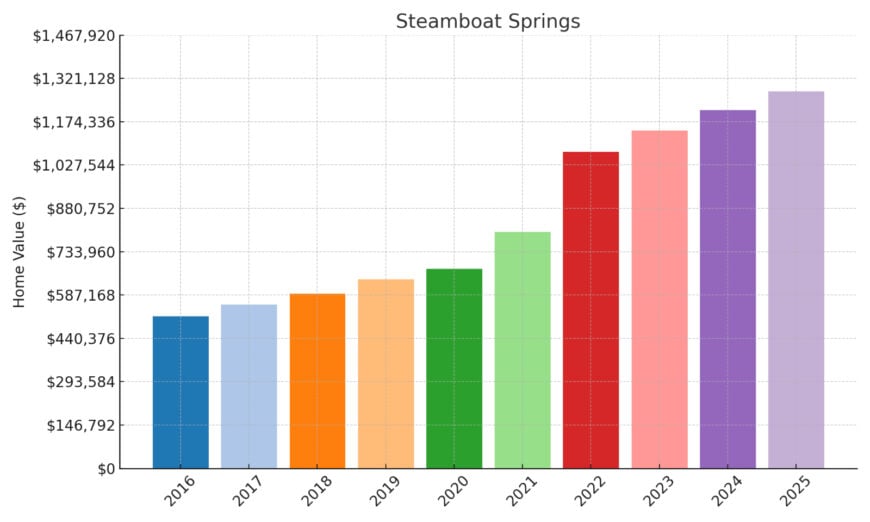

The explosive 37.2% surge in 2022 created substantial equity during the pandemic luxury boom.

Consistent growth every year indicates resilient demand rather than speculative fluctuations.

Continued 5.5% appreciation after 2022 shows sustainability when many luxury markets plateaued.

Limited inventory and world-class recreation support enduring value in this iconic mountain town.

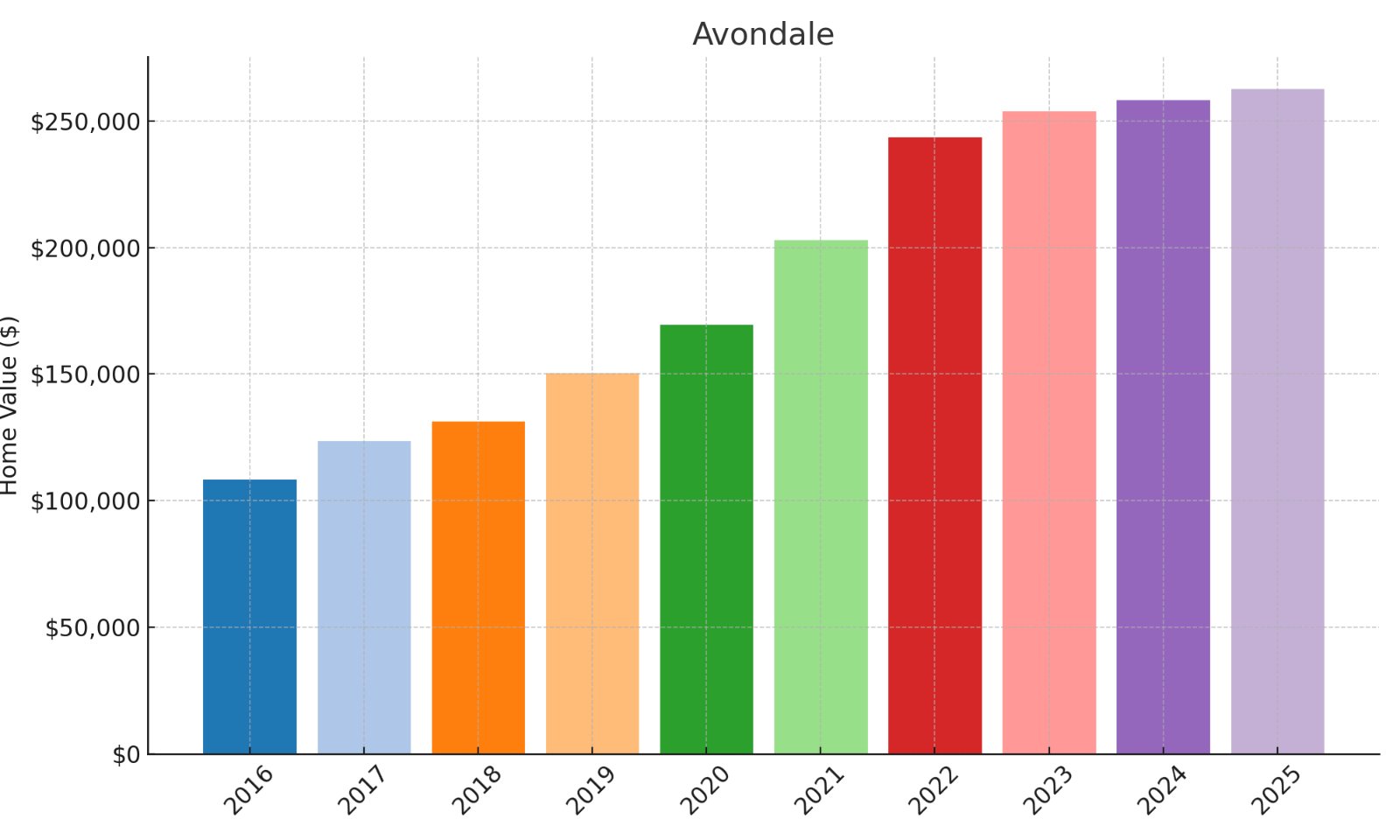

Avondale

Avondales steady 143% growth converted $108K into $262K, generating $154K in wealth.

The property gained value every single year, indicating fundamental demand rather than speculation.

Strong 19.8% growth during 2020-2021 accelerated during the pandemic relocation wave.

A 10.4% annual growth rate substantially outpaced inflation with relatively modest carrying costs.

This affordable Pueblo-area community benefits from buyers seeking Front Range alternatives.

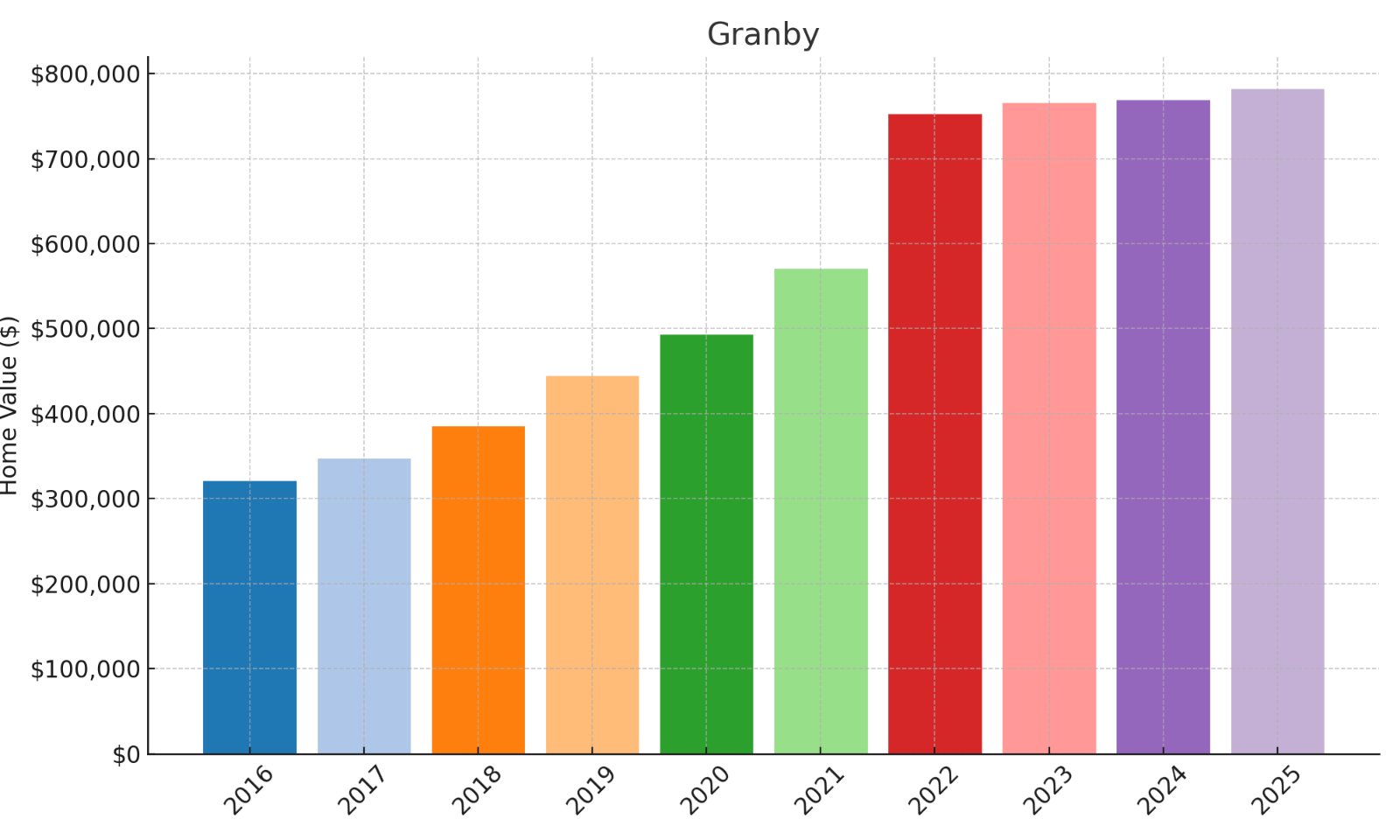

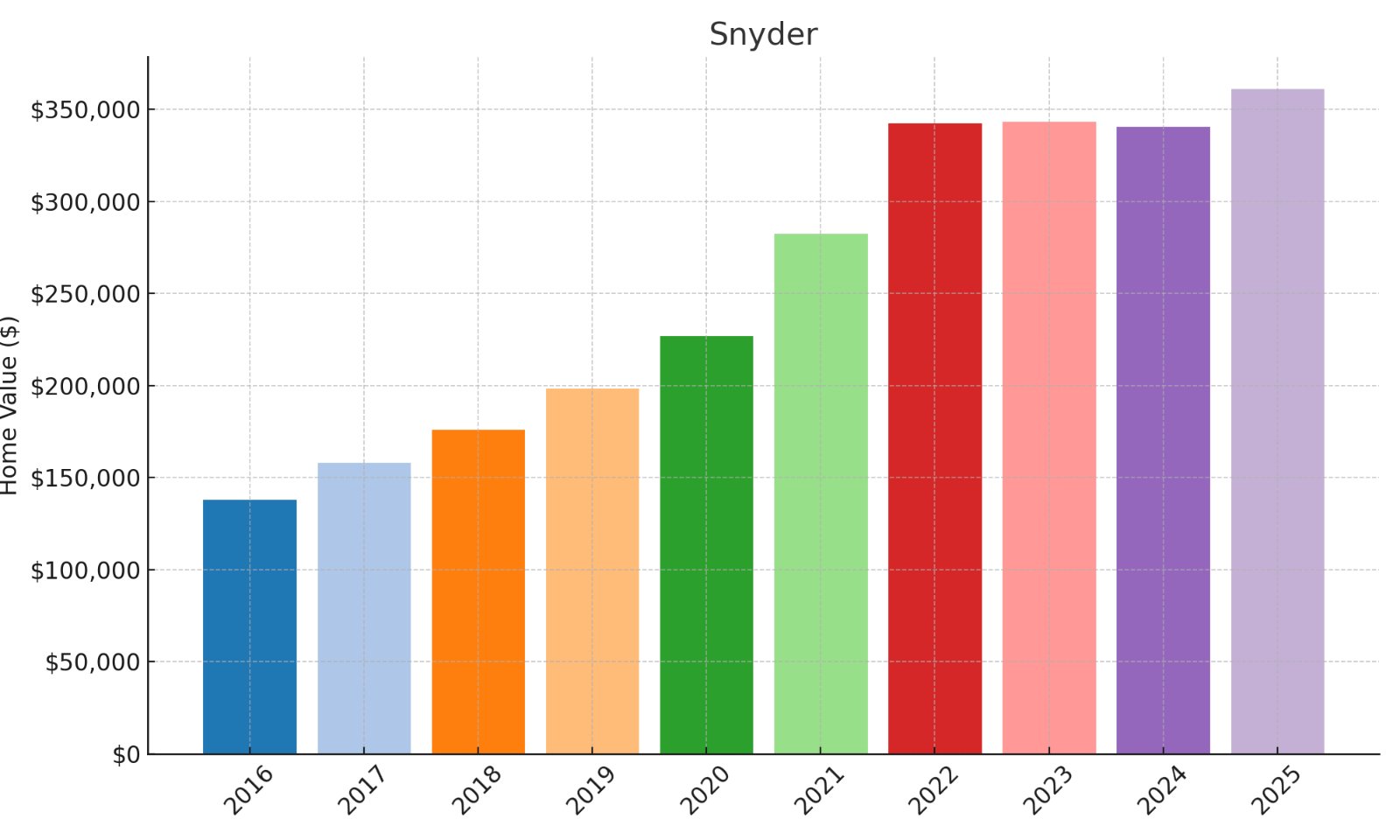

The dramatic 24.2% surge during 2020-2021 capitalized on pandemic rural relocation trends.

Despite a 4.4% correction in 2023, the market rebounded strongly with 17% growth in 2024.

An ultra-low $11.4K down payment would control an asset generating 7.2x that in equity.

This eastern Colorado community demonstrates the wealth-building power of frontier markets.

The impressive 20% surge in 2022 captured significant equity during the pandemic mountain property boom.

The propertys steady upward trajectory across all measurement years indicates resilient demand fundamentals rather than speculative activity.

The impressive 25.4% surge during 2020-2021 established significant momentum during the pandemic period.

The extraordinary 33.9% surge in 2022 created a significant wealth acceleration opportunity during the pandemic luxury boom.

The impressive 25.2% surge during 2021-2022 established significant momentum during the pandemic mountain property boom.

The propertys consistent upward trajectory in the pre-pandemic years indicates fundamental demand drivers rather than merely pandemic-related speculation.

The propertys consistent upward trajectory across multiple years indicates fundamental demand drivers rather than speculative fluctuations.

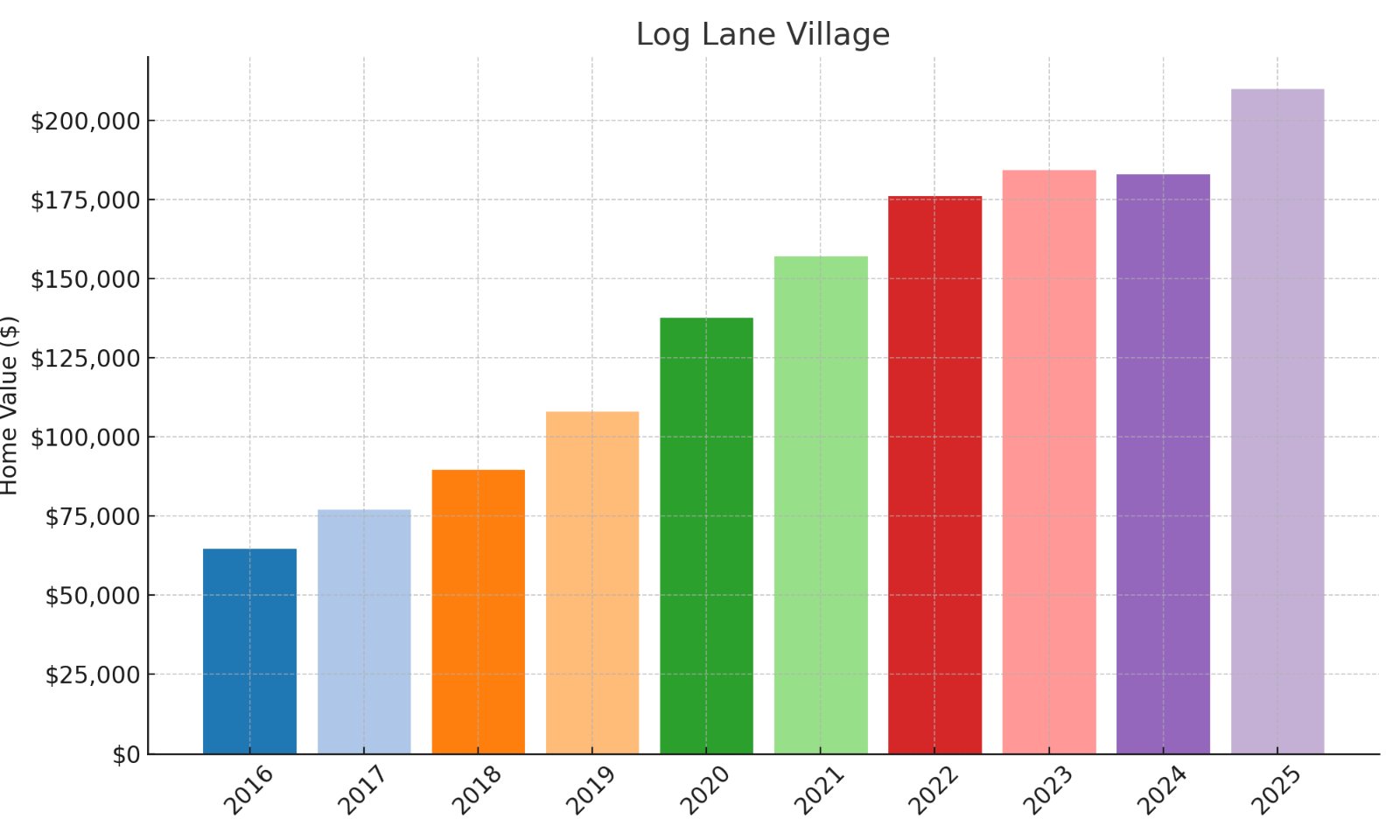

The dramatic 24.4% surge during 2020-2021 created significant momentum during the pandemic relocation wave.

This northeastern Colorado community shows resilience with an 11.3% annual growth rate, far outpacing inflation.

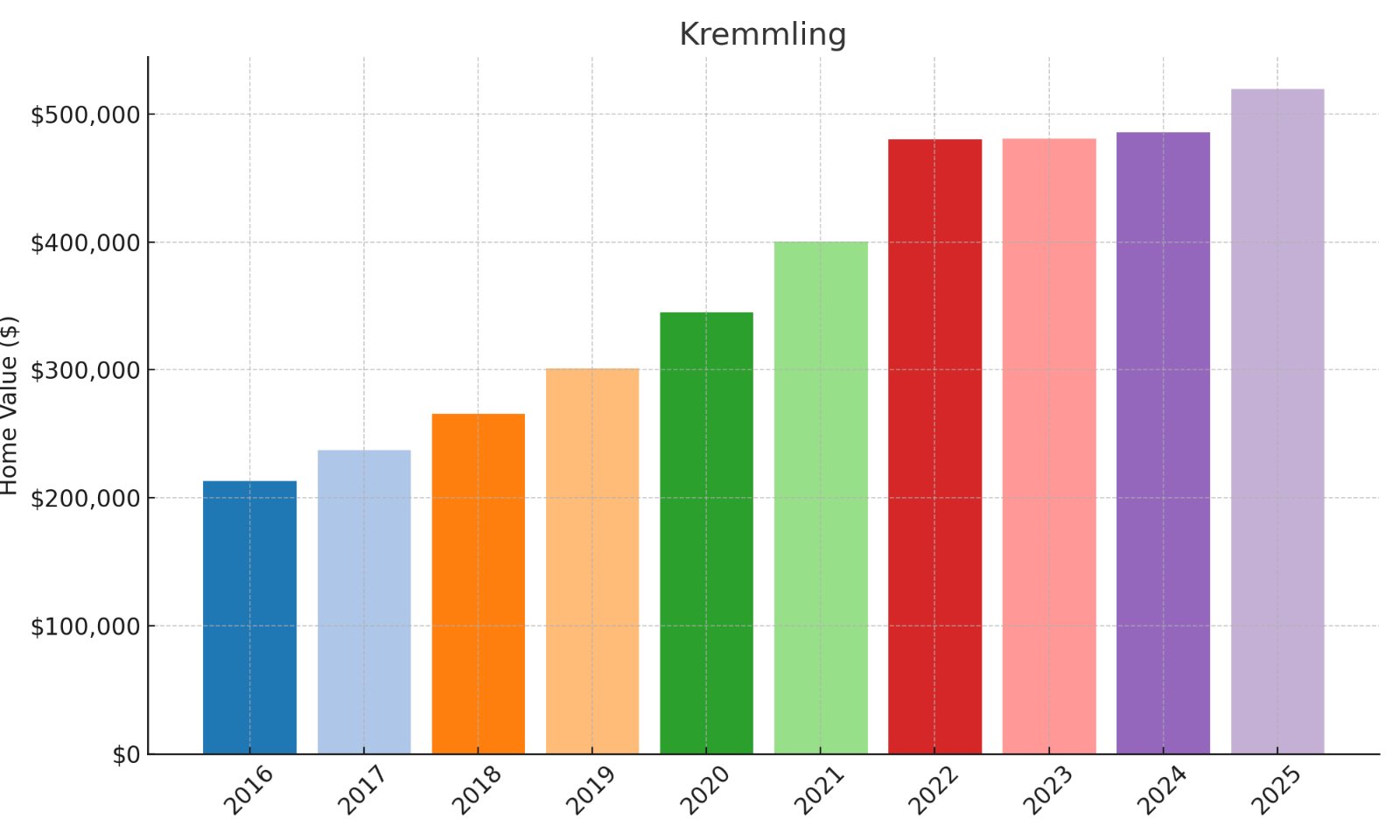

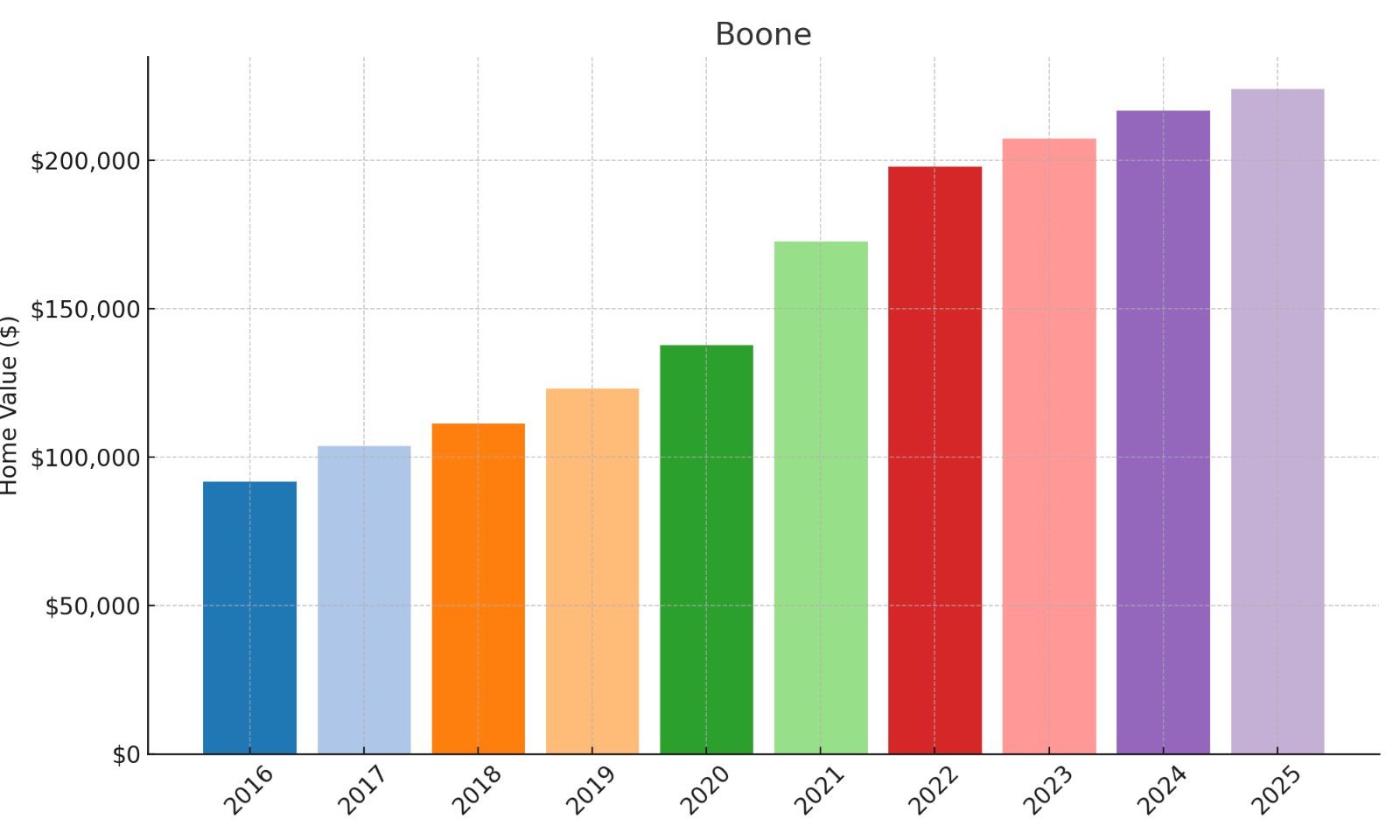

The 20% surge during 2020-2021 accelerated momentum during the pandemic mountain property boom.

Continued growth through 2022-2025 shows sustained demand driven by proximity to Steamboat Springs.

This represents an excellent value play compared to Steamboat proper with similar recreational access.

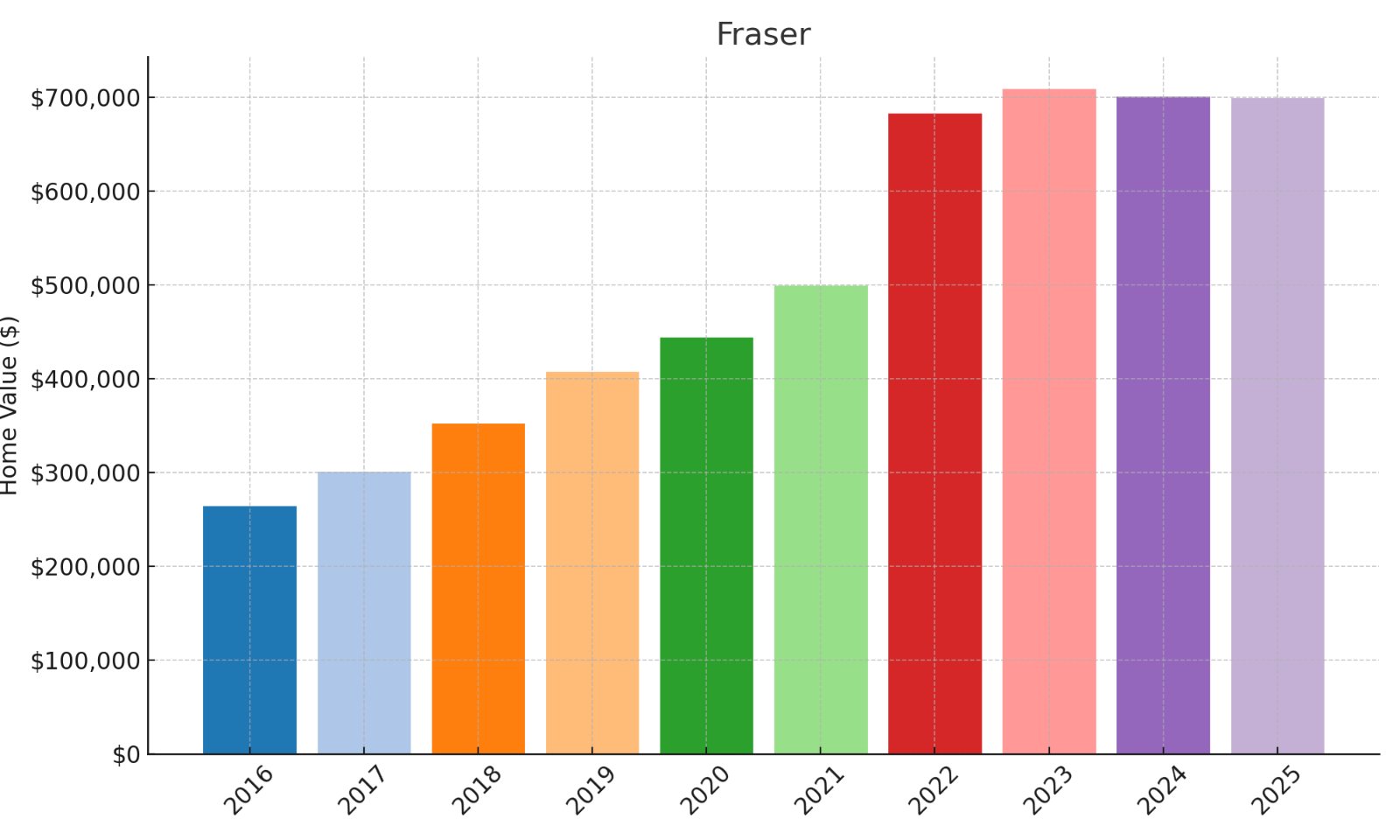

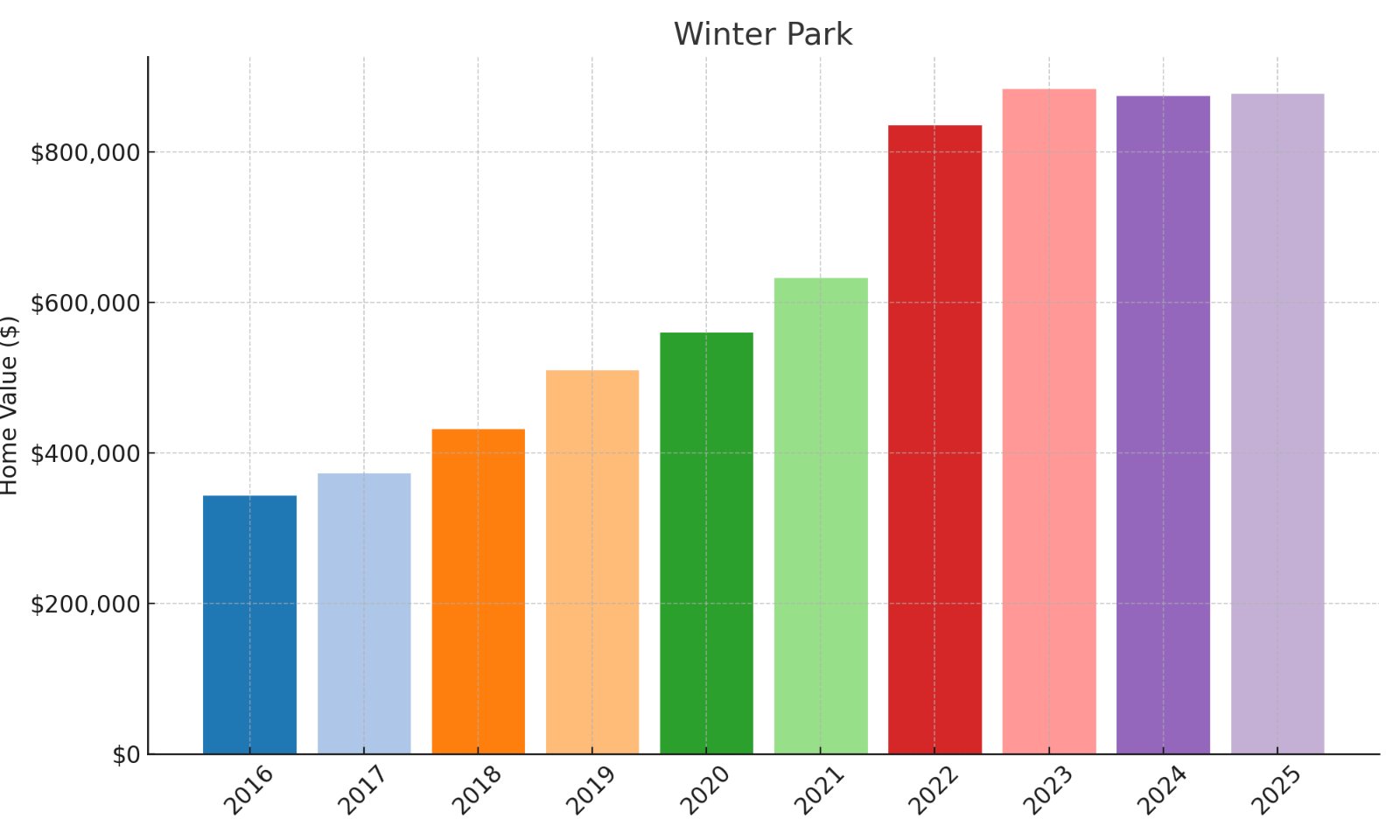

Strong 17.1% first-year appreciation (2016-2017) established momentum well before pandemic speculation.

The explosive 36.8% growth during 2021-2022 captured significant equity during the mountain property boom.

Despite minor corrections in 2024-2025 totaling 1.4%, your property maintains substantial equity.

This Winter Park-adjacent community benefits from world-class skiing and year-round recreational appeal.

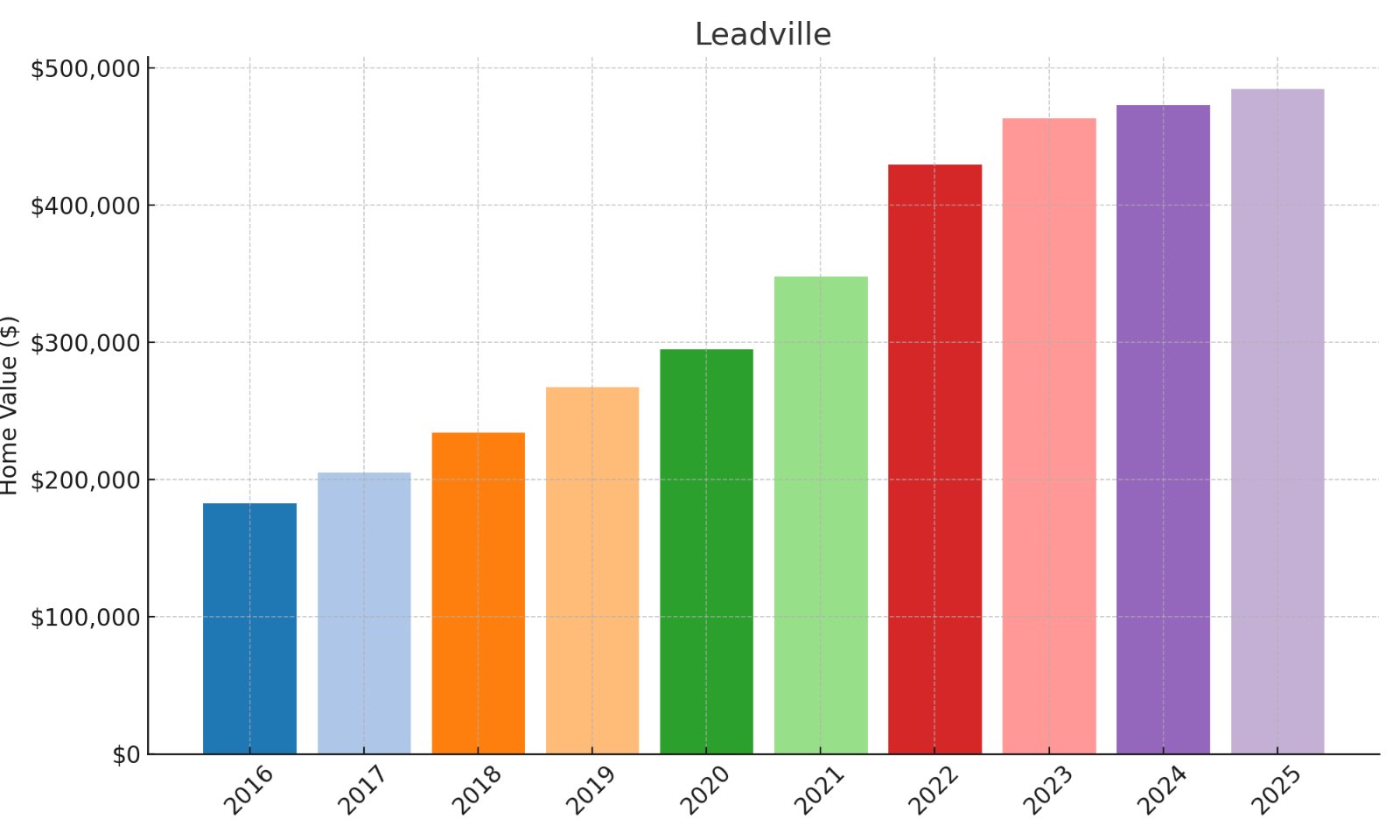

Leadville

Leadvilles outstanding 166.2% appreciation has turned $181K into $484K, generating $302K in wealth.

Your property would show consistent growth every year, indicating strong fundamental demand.

The impressive 23.5% jump during 2021-2022 created substantial momentum during the mountain boom.

Despite a slight 0.8% dip in 2024, the market rebounded impressively with 14.8% growth in 2025.

This northeastern Colorado community shows remarkably consistent performance across multiple years.

With 12.5% compound annual growth, this affordable market has far outpaced traditional investments.