This comprehensive dataset reveals not just current valuations but striking financial patterns spanning 15 years of real estate evolution.

What stands out most dramatically is the acceleration of wealth concentration in these premier locations.

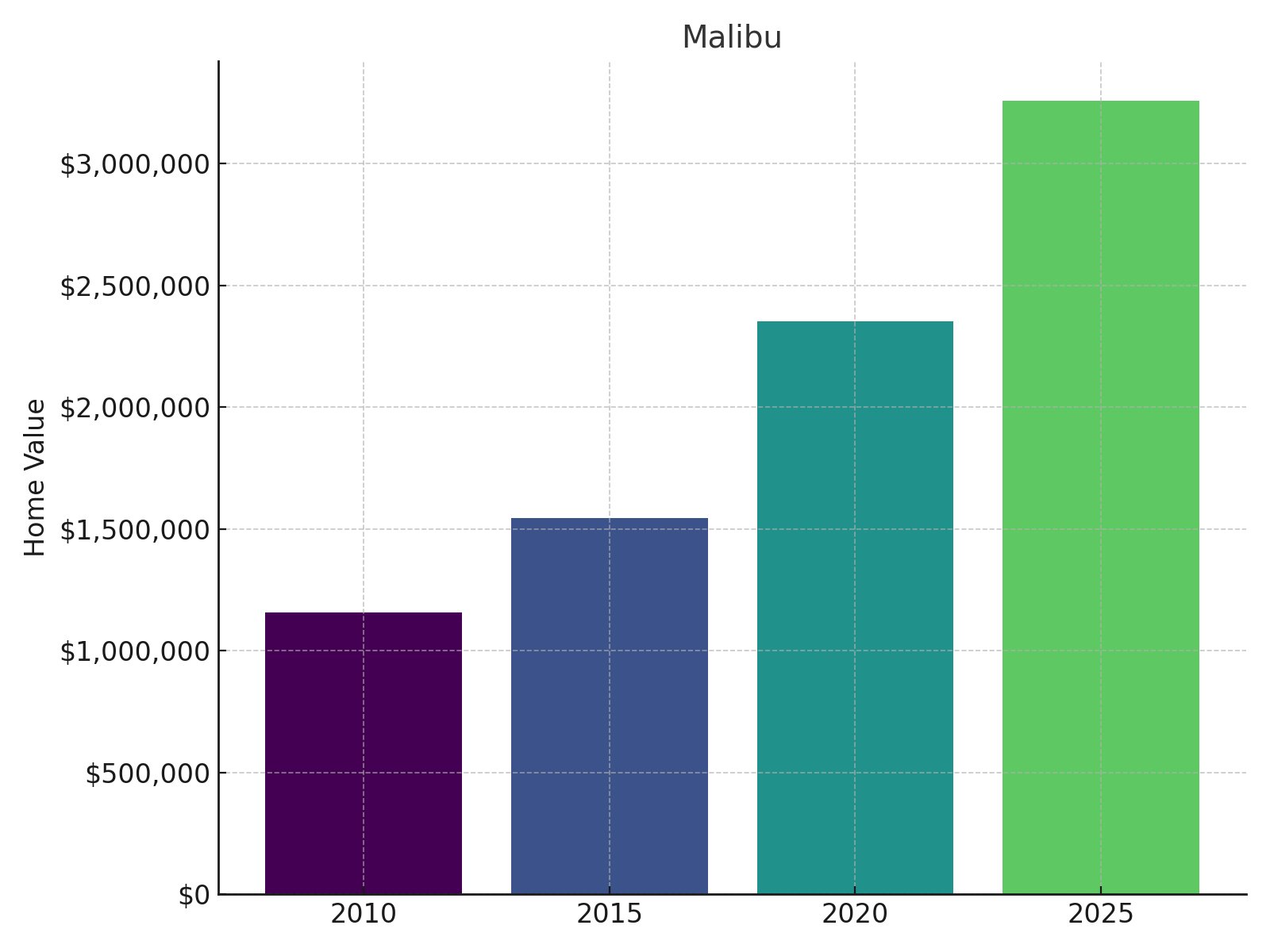

The coastal premium continues driving accelerated growth, with a substantial 54.07% jump just since 2020.

Home Stratosphere | Leaflet

Nestled along Orange Countys picturesque coastline, this artistic community combines Mediterranean-style architecture with pristine beaches.

The towns recent 46.88% five-year growth rate signals continued strong momentum despite already elevated price points.

Perched atop the Palos Verdes Peninsula, this gated equestrian community offers stunning ocean views and remarkable privacy.

While historical data before 2020 is unavailable, the consistent upward trajectory suggests strong underlying fundamentals driving demand.

The doubling of prices since 2015 demonstrates both consistent demand and the accelerating premium placed on coastal properties.

This upscale coastal city in Orange County combines harbor-front properties with pristine beaches and an established luxury retail presence.

The recent five-year growth of 55.30% indicates continuing momentum rather than a plateau despite already premium valuations.

This slower recent appreciation may signal a temporary plateau or market normalization after significant previous gains.

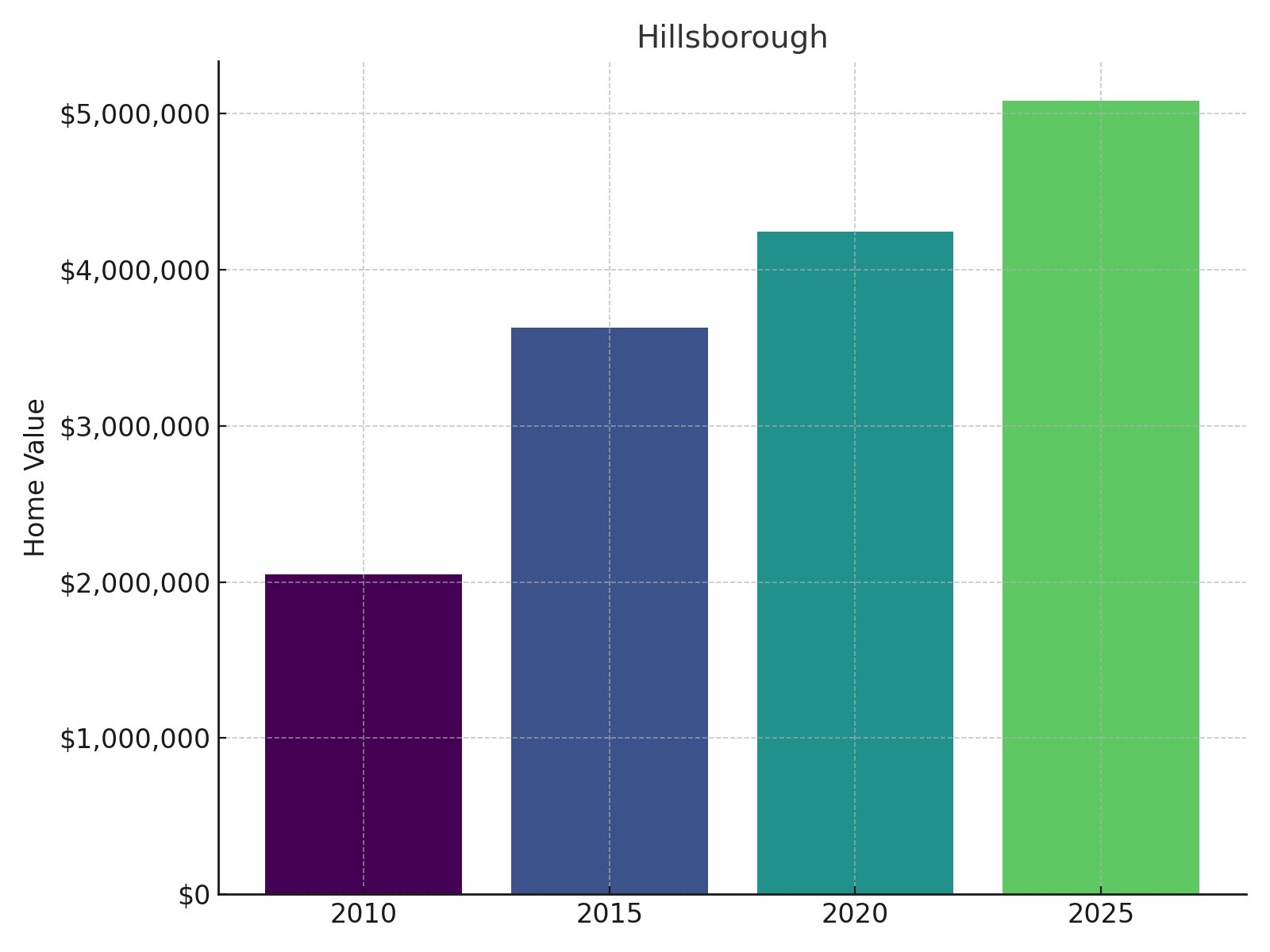

This strong but decelerating appreciation pattern suggests a maturing market finding a new equilibrium after extraordinary earlier gains.

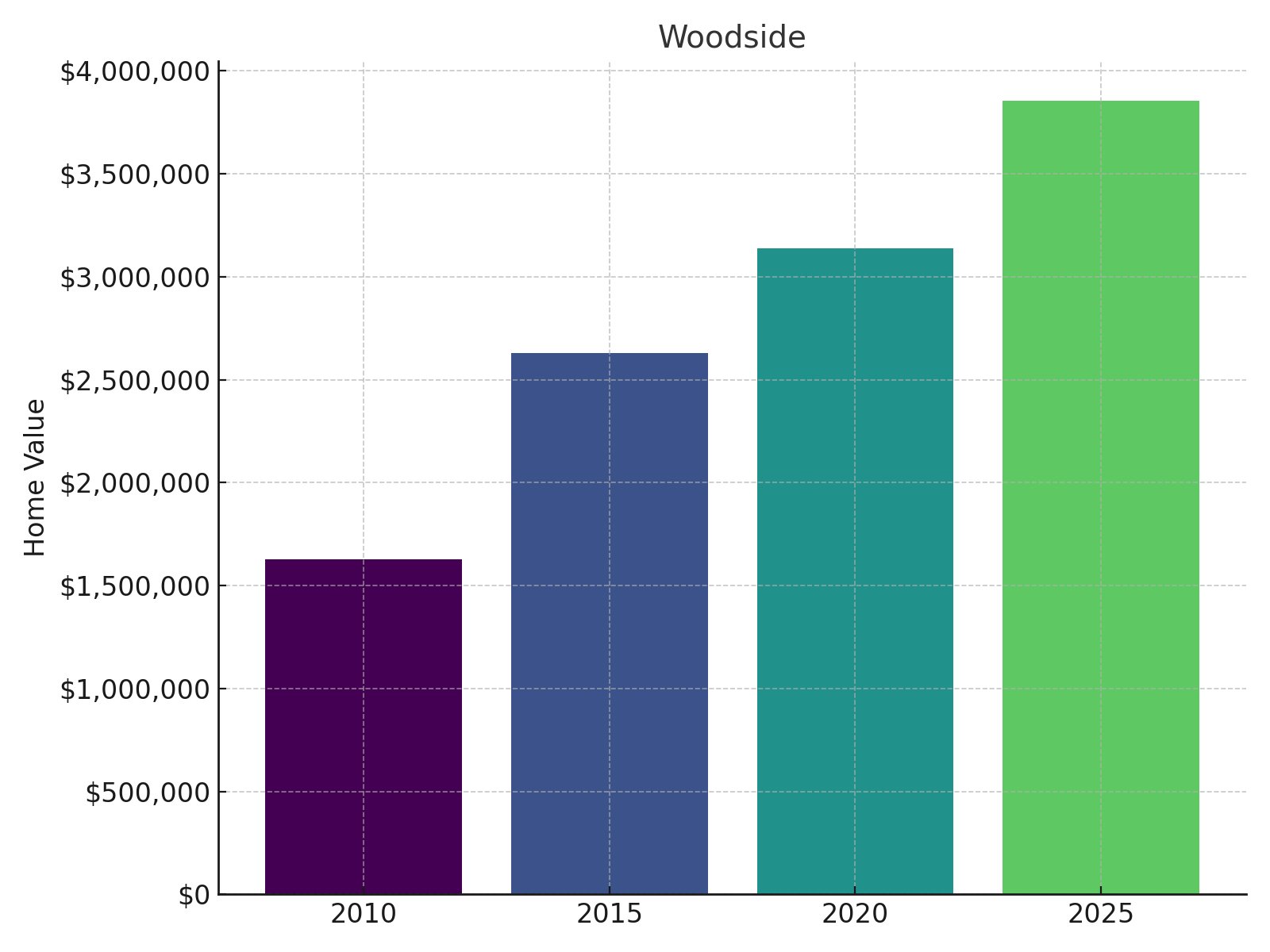

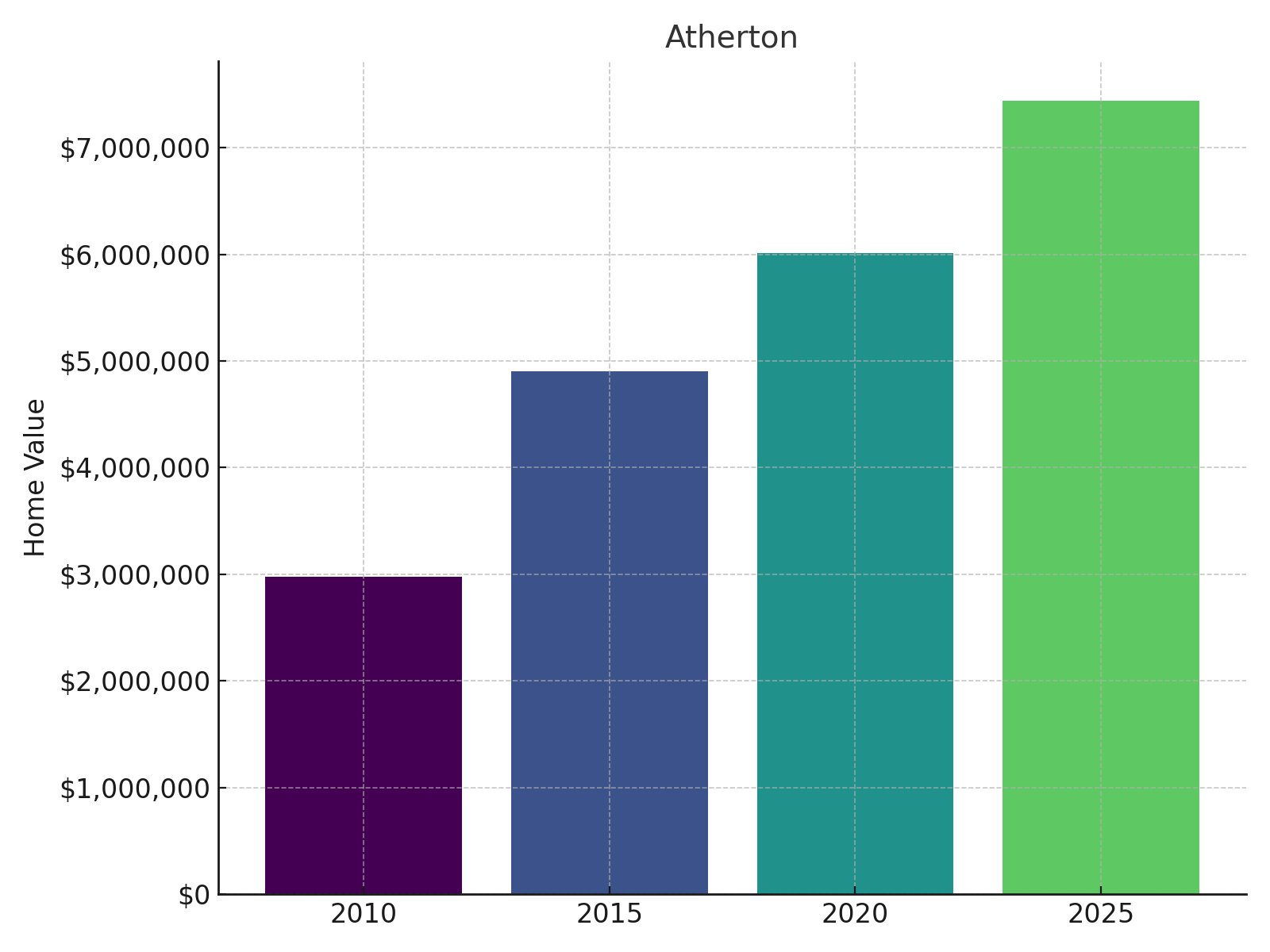

The consistent 25.75% five-year growth suggests sustainable appreciation rather than speculative momentum.

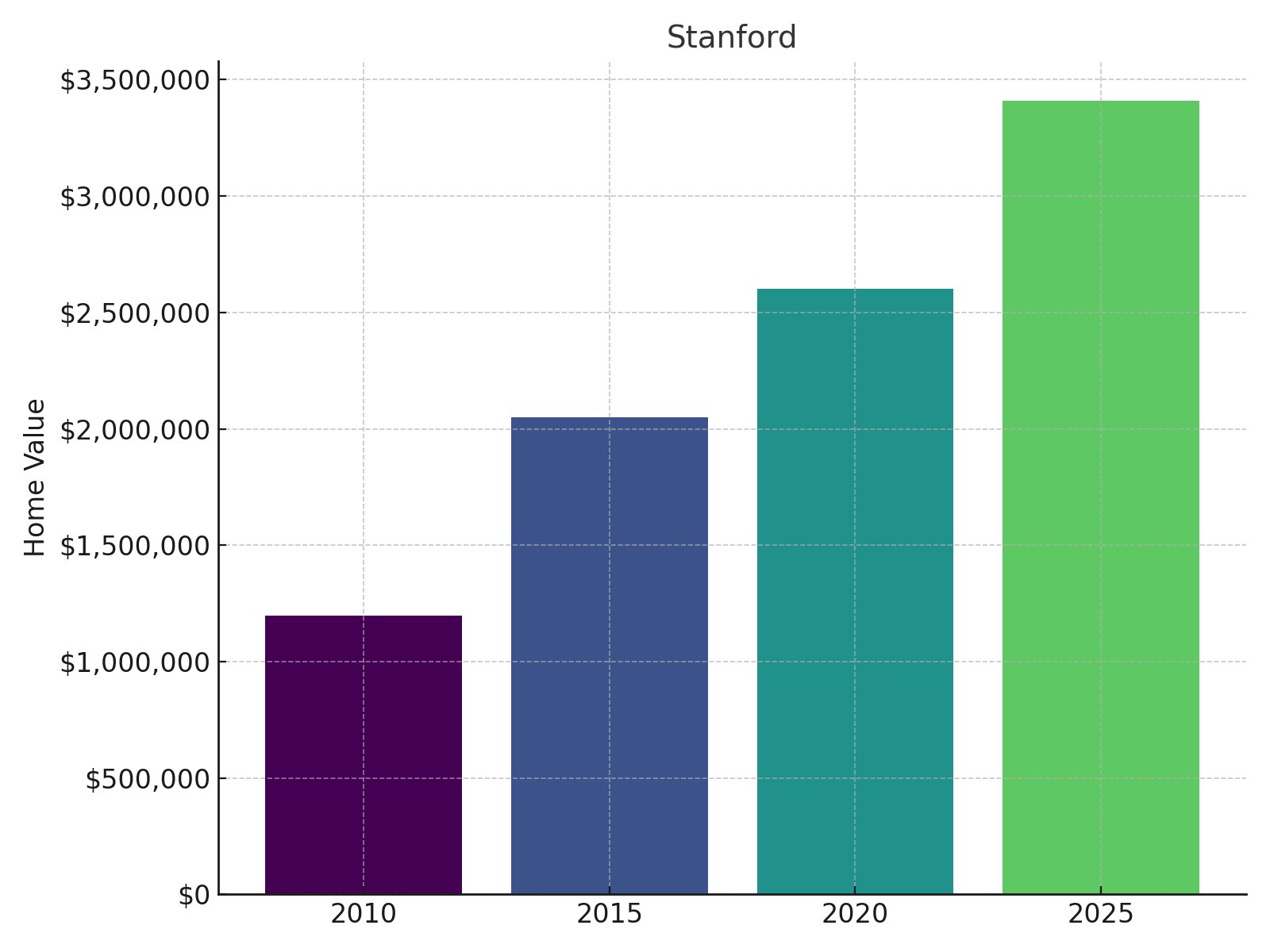

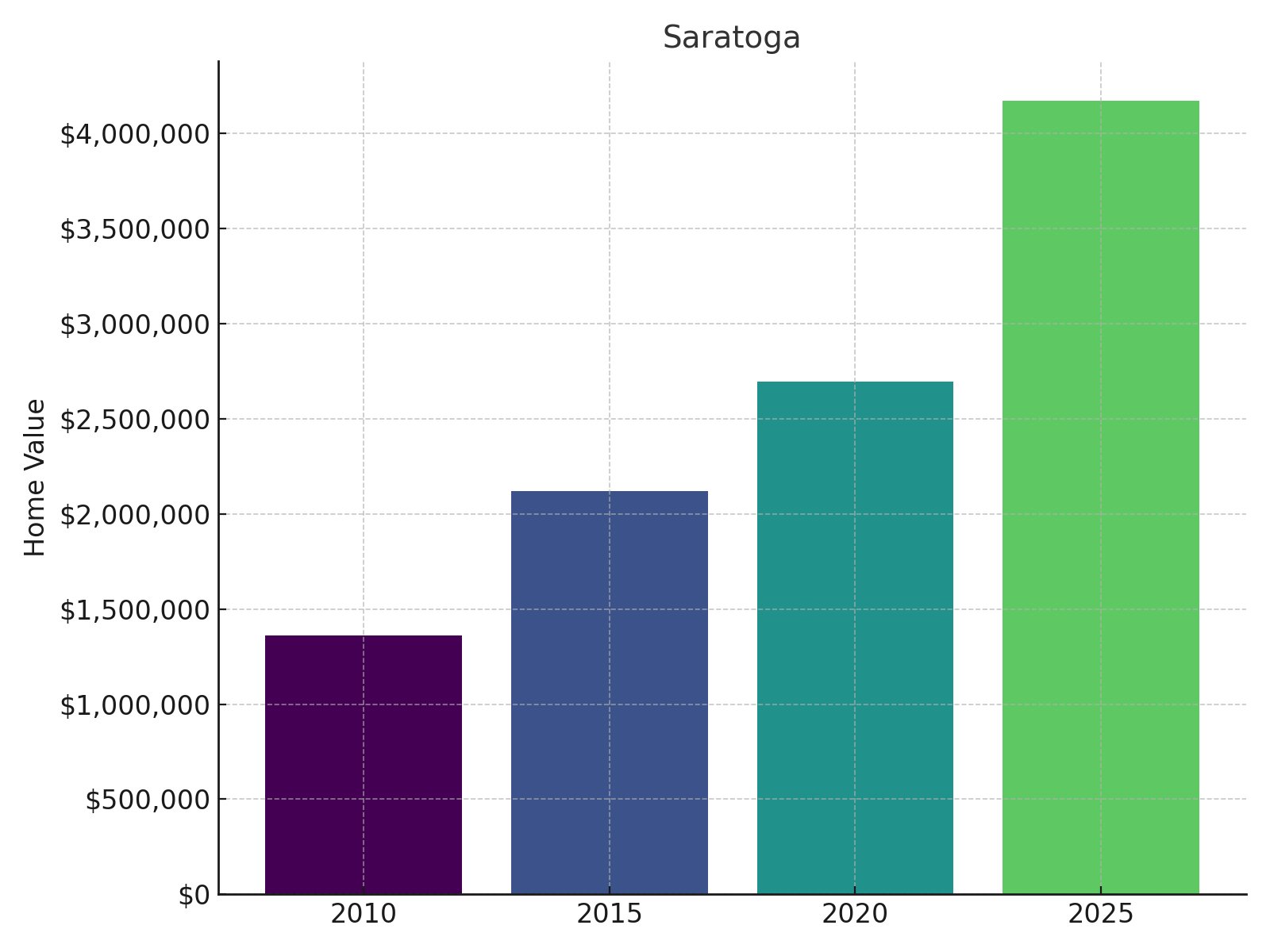

The more moderate recent five-year growth of 22.93% suggests a market finding equilibrium after earlier dramatic gains.

The consistent but moderate 24.45% growth since 2020 suggests sustainable appreciation rather than speculative momentum.

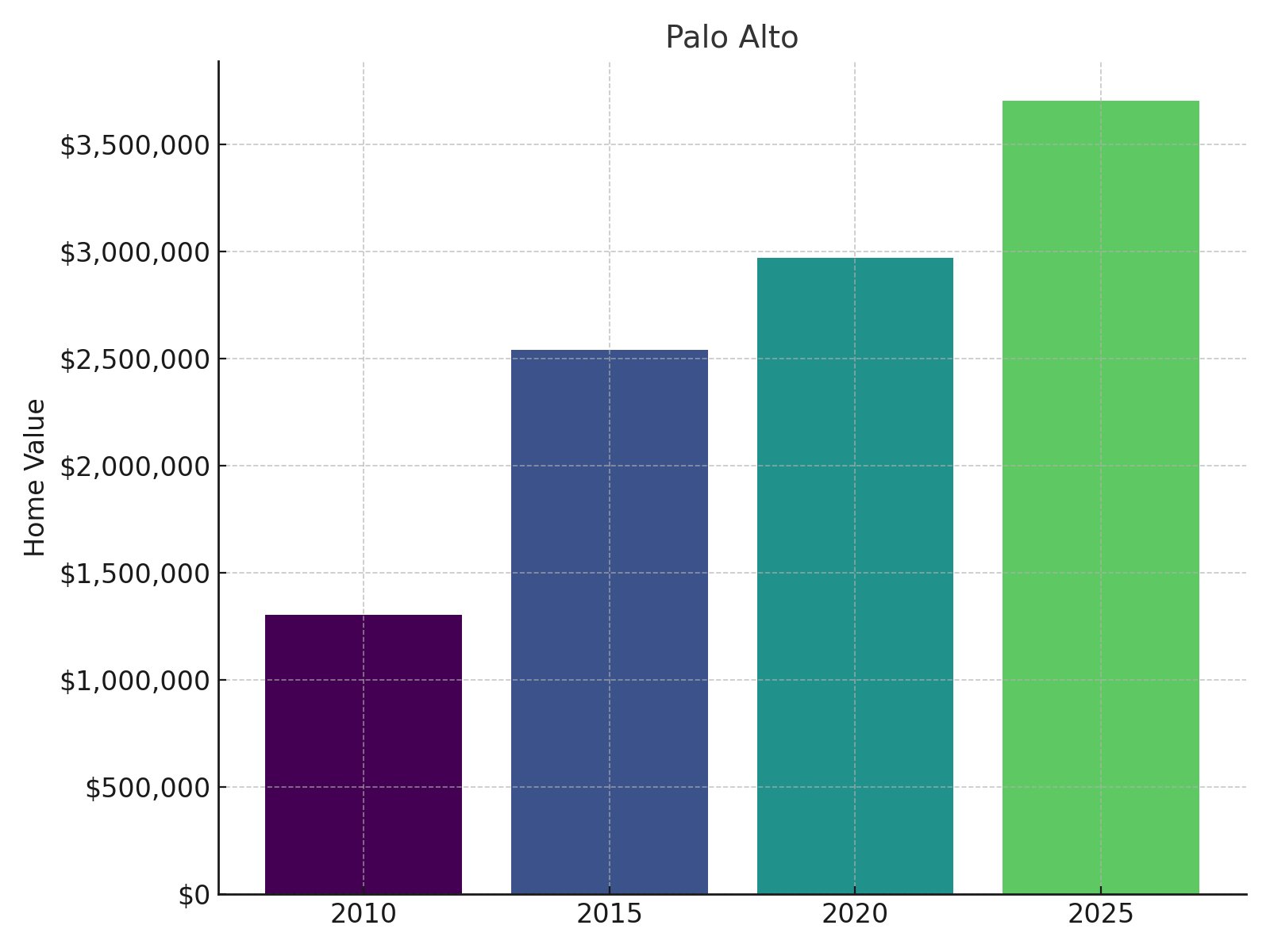

The recent acceleration to 54.72% growth over just five years indicates intensifying demand rather than market saturation.

The recent five-year growth of 46.24% demonstrates continuing strong momentum despite already premium valuations.

The strong 42.04% five-year growth rate demonstrates continuing momentum despite already premium valuations.

The recent five-year surge of 50.63% signals increasing premium valuation rather than market saturation despite already elevated prices.

This pattern suggests market maturity rather than speculative momentum in an already premium community.

The fifteen-year appreciation of 148.97% represents consistent outperformance relative to inflation and most traditional investments.

This pattern suggests market maturation rather than speculative momentum at these ultra-premium price points.

This pattern suggests price stabilization at ultra-premium levels rather than market weakness.