Ive analyzed theZillow Home Value Indexdata to identify Kentuckys fastest-growing property markets over the past decade.

The results reveal astonishing growth patterns that defy conventional expectations about rural real estate.

Whats particularly striking is the magnitude of growth in smaller communities.

Home Stratosphere | Leaflet

These patterns suggest targeted investment opportunities that could yield similarly impressive returns in the coming years.

Junction City

The consistent appreciation in Junction City signals a market with solid fundamentals rather than speculative activity.

Current price points still present an accessible entry compared to nearby markets, making it attractive for buy-and-hold strategies.

Junction City sits at the intersection of three counties, creating unique economic advantages worth leveraging.

The 2024-2025 surge of nearly $27K demonstrates momentum that savvy investors should monitor closely.

Situated near the Tennessee border, Allensville benefits from cross-state economic influences while maintaining Kentuckys tax advantages.

Cash flow potential remains strong at these price points, especially for investors targeting rental yields alongside appreciation.

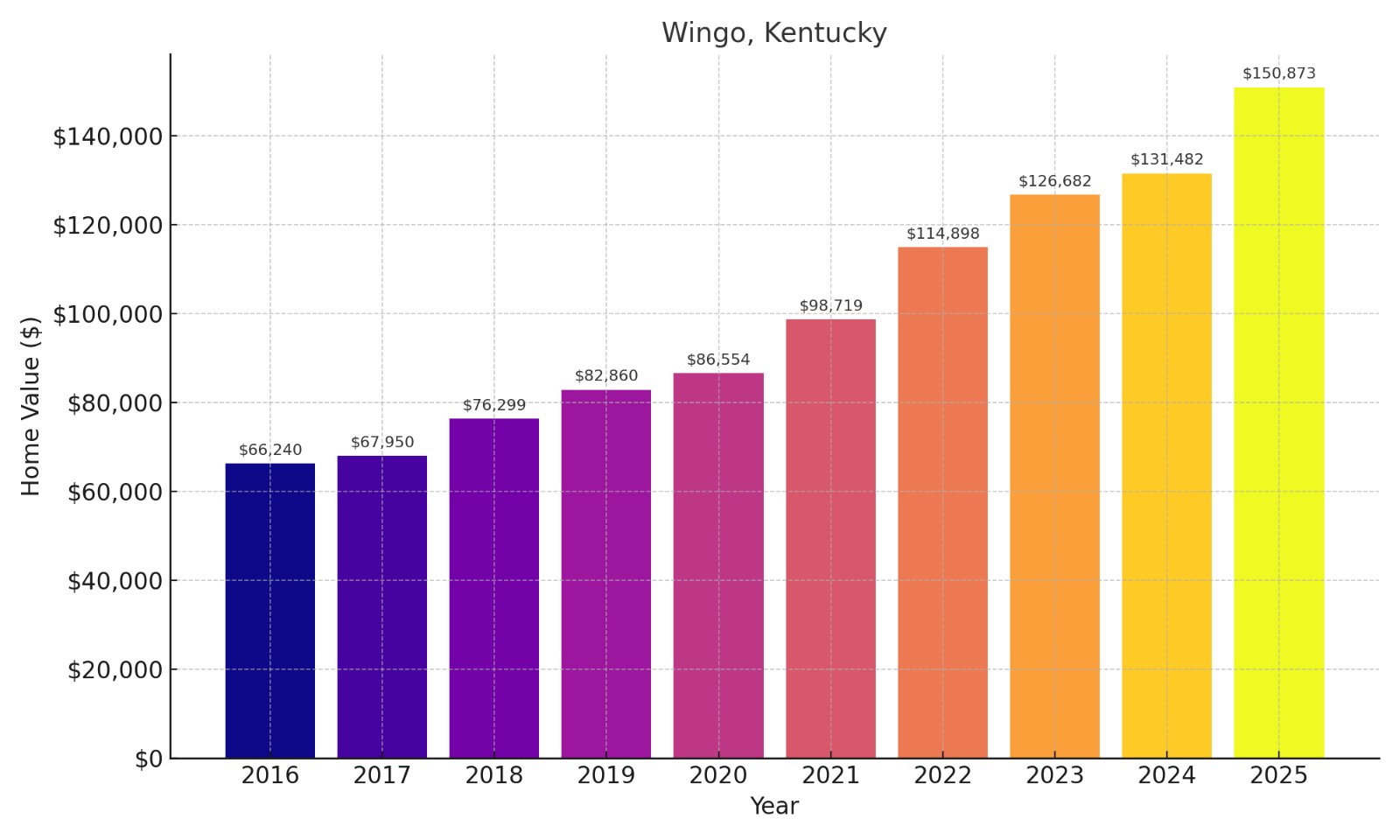

Positioned in the western Purchase Region, Wingos growth correlates with broader economic development throughout Kentuckys western corridor.

Summer Shade

Summer Shade shows remarkable resilience, with values consistently climbing through economic fluctuations and pandemic effects.

For long-term investors, the data suggests sustainable growth rather than a speculative bubble that might soon burst.

Investors who bought in 2020 have already seen approximately 72% returns in just five years.

The massive 63% growth since 2020 suggests accelerating momentum rather than a market reaching its peak.

Cash flow potential remains particularly strong at these price points, making it attractive for income-focused property investors.

Stanton

Stantons property market has demonstrated remarkable resilience, with values more than doubling despite broader economic uncertainties.

Your investment horizon should recognize that early-stage growth markets often experience compounding effects as awareness increases.

Such consistent appreciation while maintaining relatively affordable price points suggests significant upside potential still exists.

Current valuations indicate positive cash flow opportunities for rental investors, with cap rates likely exceeding most urban markets.

Dunnville

Dunnvilles property values have demonstrated extraordinary resilience, with consistent gains even through economic uncertainty and pandemic disruptions.

The $18K jump between 2024-2025 signals accelerating momentum that savvy investors should monitor closely.

Historical data suggests steady appreciation rather than volatile swings, indicating fundamentals-driven growth rather than speculation.

The impressive $23K single-year gain between 2024-2025 indicates accelerating momentum rather than a market reaching its peak.

The unusual price fluctuations between 2023-2025 suggest a maturing market finding its equilibrium rather than a fundamental weakness.

The market shows unusual resilience through economic fluctuations, with only minor depreciation during 2022-2023 followed by renewed appreciation.

Current trends suggest continued momentum toward $250K, with particularly strong growth in the post-pandemic era.

The impressive $21K jump between 2024-2025 signals accelerating momentum rather than a market reaching its peak.

Investors who purchased in 2020 have already realized approximately 47% returns in just five years.

The steady appreciation through economic fluctuations demonstrates market resilience rather than speculative activity.

Current trends suggest continued progression toward $175K, with particularly strong growth in the post-pandemic era.

Analysis of the decade-long trend reveals approximately 10.7% compound annual growth exceptional performance that justifies investor attention.

The consistent year-over-year gains suggest fundamentals-driven growth rather than speculative activity that might suddenly reverse.

The market shows acceleration rather than plateauing, with a remarkable 14.3% gain between 2024-2025 suggesting continued momentum.

The unusual valuation pattern since 2021 suggests market normalization after extraordinary growth rather than fundamental weakness.

Even with the recent adjustment, investors who purchased in 2016 have realized over $74K in equity growth.

The remarkable 36.6% single-year surge between 2024-2025 indicates accelerating momentum rather than a market reaching its peak.